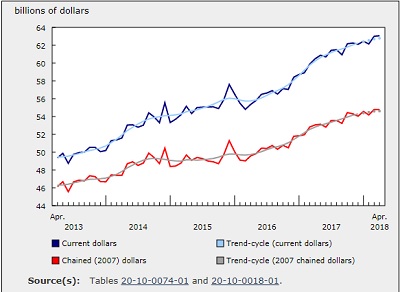

Wholesale Trade Up 0.1% in April

June 29, 2018

Wholesale sales edged up 0.1% to $63.1 billion in April. Sales were up in three of seven subsectors, accounting for 54% of total wholesale sales.

Wholesale sales edged up 0.1% to $63.1 billion in April. Sales were up in three of seven subsectors, accounting for 54% of total wholesale sales.Increases in the machinery, equipment and supplies and the food, beverage and tobacco subsectors were almost completely offset by declines in the motor vehicle and parts subsector.

In volume terms, wholesale sales were unchanged at $54.8 billion.

Increase attributable to higher sales in three of seven subsectors

The machinery, equipment and supplies subsector rose for the third consecutive month, up 2.3% to $13.0 billion in April. This was the largest monthly dollar increase since December 2017. Sales were up in three of four industries, led by the construction, forestry, mining, and industrial machinery, equipment and supplies industry (+5.8%). Imports of logging, mining and construction machinery have also risen for three consecutive months.

Sales in the food, beverage and tobacco subsector were up 1.9% to $12.1 billion, mainly on the strength of higher sales in the food industry (+2.0%). The gains in the food industry in April more than offset the 1.7% decline reported in March. Exports of food, beverage and tobacco products increased in April.

Wholesale sales in the personal and household goods subsector increased 1.5% to a record $8.9 billion. Sales were up in four of six industries, led by the home entertainment equipment and household appliance industry (+6.0%).

Offsetting most of the gains in April, the motor vehicle and parts subsector fell 4.0% to $11.5 billion, the largest percentage decline since November 2016. Following an 8.4% increase in March, the motor vehicle industry was down 4.6% in April. Despite the decline, sales were 2.3% higher than the same month last year. Imports of passenger cars and light trucks fell 8.9% in April, following a 13.4% gain in March.

Sales up in seven provinces

Wholesale sales rose in seven provinces in April, led by British Columbia and Quebec.

Sales in British Columbia were up 1.6% to a record $6.6 billion. The building material and supplies subsector (+8.0%) contributed the most to the gain. This was the second consecutive monthly increase for both the province and the subsector.

In dollar terms, Quebec was the second largest contributor to the increase in April, rising 0.9% to $11.5 billion, its second consecutive monthly gain. The machinery, equipment and supplies subsector (+6.3%) contributed the most to the increase in Quebec.

Sales were up in Alberta (+0.7% to $6.8 billion) and in Saskatchewan (+1.0% to $2.1 billion). Sales in the machinery equipment and supplies subsector led the gains in both provinces. This was the fourth increase in five months for Alberta, while sales increased for the second consecutive month for Saskatchewan.

Nova Scotia and Newfoundland and Labrador also recorded gains as a result of higher sales in the food, beverage and tobacco subsector. Sales in Nova Scotia rose 1.9% to $861 million, its fourth consecutive monthly gain, while sales in Newfoundland and Labrador were up 2.9% to $344 million, following three consecutive monthly declines.

Sales declined 0.7% to $32.6 billion in Ontario on weaker sales in the motor vehicle and parts subsector. This was the second decline in three months for the province.

In Manitoba, sales decreased for the third consecutive month, down 1.0% to $1.6 billion, led by the miscellaneous subsector.

Wholesale inventories edge up in April

Wholesale inventories edged up 0.1% in April to $82.6 billion, the first increase in three months. Higher inventories in four subsectors, representing 45% of total wholesale inventories, offset declines in three subsectors.

The miscellaneous subsector rose 3.4% in April, the fifth increase in six months. Increases in the agricultural supplies industry (+5.1%) led the rise.

Inventories in the building material and supplies subsector were up 1.4%, a second consecutive increase. Higher inventories were recorded in all three industries, led by the lumber, millwork, hardware and other building supplies industry (+2.1%).

The motor vehicle and parts subsector rose for the second time this year, up 0.7% in April. Inventories in the motor vehicle industry (+1.1%) contributed the most to the gain.

Inventories in the food, beverage and tobacco subsector (-2.5%) reported the largest dollar-value decline. This was the third decrease in four months for the subsector.

The inventory-to-sales ratio was unchanged at 1.31 in April. This ratio is a measure of the time in months required to exhaust inventories if sales were to remain at their current level.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/180621/dq180621a-eng.htm