Philips to Sell Majority of LED Components and Automotive Lighting Business, Including US Lumileds

Royal Philips has announced an agreement with a consortium led by GO Scale Capital through which they will acquire an 80.1% interest in Philips’ combined LED components and automotive lighting business. Philips will retain the remaining 19.9% interest. This includes a 34% interest in the Lumileds US operations.

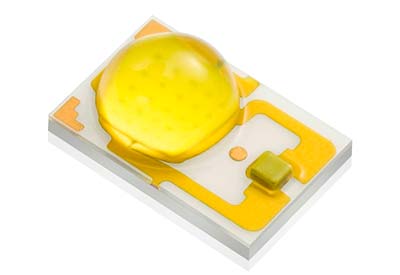

The new company will continue under the name Lumileds, led by CEO Pierre-Yves Lesaicherre. Lumileds is a leading supplier of lighting components to the general illumination, automotive and consumer electronics markets with operations in more than 30 countries and has approximately 8,300 employees worldwide. In 2014, it generated sales of approximately US$2 billion. Philips’ Lighting Solutions business will remain a key customer of Lumileds.

The transaction values the business at an enterprise value of approximately USS3.3 billion. Philips expects to receive cash proceeds, before tax and transaction related costs, of approximately US$2.8 billion and a deferred contingent payment of up to US$100 million. The transaction is expected to be completed in the third quarter of 2015.

“Philips is very positive about this transaction with GO Scale Capital as its principals are long-term, growth-oriented investors with a track record of building and expanding technology companies,“ says Frans van Houten, CEO of Royal Philips. “We have significantly improved the performance of the LED components business and optimized the industrial footprint in the automotive lighting business over the last few years, and established a strong management team and innovation pipeline. We are therefore convinced that together with GO Scale Capital, Lumileds can grow further, attract more customers and increase scale as a stand-alone company.“

GO Scale Capital is a new investment fund sponsored by GSR Ventures and Oak Investment Partners. The consortium partners are Asia Pacific Resource Development, Nanchang Industrial Group and GSR Capital. The GO Scale Capital team has technology expertise and a track record in scaling up disruptive technologies. Current investments include Boston Power, a U.S.-based manufacturer of electric vehicle batteries, and Xin Da Yang, a leading Eco-EV company in China. The team brings deep knowledge of the LED components and automotive technology industries. Through their past investments in the LED industry, they have access to complementary technologies and manufacturing capacity. This uniquely complements Lumileds’ high-power LED manufacturing footprint and expertise, and the combination offers opportunities for the company to pursue further growth and scale.

“The Lumileds acquisition will be a perfect example of how GO Scale turns cutting edge technologies into world class companies,” says Sonny Wu, co-founder and managing director of GSR Ventures and chairman of GO Scale Capital. Wu will serve as interim chairman of Lumileds following the completion of the transaction.

GO Scale Capital will focus on expanding Lumileds’ opportunities by investing in its global centers of operation and in the fast growing general lighting and automotive industries. “Through Lumileds’ world-leading technology in key verticals such as LED chips, LED mobile flash and automotive lighting, together with a customer base including the likes of BMW, Volkswagen and Audi, we expect to see significant growth and unparalleled inroads into new opportunities such as electric vehicles,” says Wu.

Following the separation of Lumileds, Philips Lighting will focus on the growing lighting solutions markets in which it has leading market positions. As previously announced in September 2014, Philips has started the process of creating two market-leading companies focused on HealthTech and Lighting Solutions opportunities.