Monthly Survey of Manufacturing, January 2022

March 15, 2022

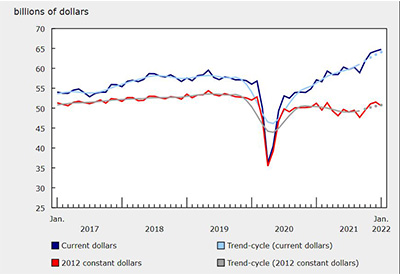

Manufacturing sales rose for the fourth consecutive month, up 0.6% to $64.8 billion in January on higher sales in 14 of 21 industries, led by the petroleum and coal (+6.8%) and wood (+6.5%) product industries. The gain was partially offset by lower sales of motor vehicles (-17.5%). On a year-over-year basis, total manufacturing sales were up 13.4% in January.

Sales in constant dollars decreased 1.8% in January, indicating the modest monthly growth was a result of rising prices as the Industrial Product Price Index increased 3.0% month over month in January.

Petroleum and coal posts record sales on higher prices

Following a 0.7% decline in December, petroleum and coal product sales rose 6.8% to $7.9 billion in January, the highest level on record. The gain was driven by higher prices of refined petroleum products (+10.6%), which largely reflects an increase in the price of crude oil. Sales of petroleum and coal product in constant dollars fell 1.3%. Meanwhile, exports of refined petroleum energy products rose 7.5% in January.

Sales of wood products rose 6.5% to $4.1 billion in January, the fifth consecutive monthly increase, driven as well by higher prices. Sales in constant dollars were unchanged. Prices of lumber and other sawmill products increased 14.6%, mostly on higher prices of softwood lumber. Exports of building and packaging materials increased 6.6% in January. Despite the gain in January, wood sales were down 2.0% in January compared with the same month a year earlier.

Sales also increased in the non-metallic mineral product (+10.6%), fabricated metal product (+3.7%) and paper (+5.4%) industries in January.

Sales of motor vehicles fell 17.5% to $3.0 billion in January, following three consecutive monthly increases. Meanwhile, sales of motor vehicle parts were down 7.1%. Several motor vehicle assembly plants experienced production shutdowns in January due to supply chain disruptions and semiconductor shortages. The capacity utilization rate of the motor vehicle industry dropped accordingly. Sales of motor vehicles were down 20.4% year over year and exports of motor vehicles and parts fell 9.6% in January.

Following three consecutive monthly gains, sales of primary metals fell 5.0% to $5.5 billion in January on lower sales of non-ferrous metals (except aluminum) and iron and steel mills and ferro-alloy products. Nevertheless, sales of primary metals stood 24.0% higher compared with January 2021.

Other industries that contributed to the decline in January were the plastic and rubber (-1.6%) and aerospace product and parts (-2.4%) industries.

Quebec posts the largest sales increase

Manufacturing sales increased in five provinces in January, led by Quebec and British Columbia. Meanwhile, Ontario and Saskatchewan posted the largest declines.

In Quebec, sales increased 3.9% to $17.0 billion in January on higher sales in 15 of 21 industries, led by the petroleum and coal product, fabricated metal product and transportation equipment industries. Sales of primary metals decreased the most, down 4.4% to $2.5 billion in January.

In British Columbia, sales increased 4.3% to $5.5 billion in January, led by the wood (+11.5%) and paper (+24.6%) product industries. The wood product industry has become the largest manufacturing industry in British Columbia since June 2020 and contributed 24.2% to total manufacturing sales in January.

Sales in Ontario decreased 1.3% to $27.7 billion in January, mainly on lower sales of motor vehicles (-17.2%), primary metals (-7.6%) and motor vehicle parts (-7.1%). Motor vehicle and part production was impacted by shutdowns at some auto assembly plants due to semiconductor shortages. On a year-over-year basis, sales declined 20.7% in the motor vehicle and 6.6% in the motor vehicle part industries in Ontario.

Sales in Saskatchewan decreased 6.0% to $1.7 billion in January, the third consecutive monthly decline, primarily on lower sales of chemicals.

Montréal reports the largest sales in dollars terms increase among select census metropolitan areas

Manufacturing sales increased in 4 of the 12 select census metropolitan areas in January. Sales in Montréal and Québec rose the most, while Regina and Toronto posted the largest declines.

In Montréal, sales rose 4.3% to $7.4 billion in January, mostly on higher production of aerospace product and parts (+25.4%).

Sales in Québec were up 15.7% to $1.9 billion in January, mostly on higher sales of petroleum and coal products.

Meanwhile, sales in Regina were down 23.3% to $630.5 million in January on lower sales at chemical manufacturers due to below seasonal sales of pesticide, fertilizer and other agricultural chemical products.

In Toronto, following three consecutive monthly increases, sales declined 0.9% to $10.9 billion, driven by lower sales of transportation equipment, primary metals, beverage and tobacco product and plastics and rubber products industries.

Record-high inventory levels continue

Total inventories increased 1.8% to a new record high of $105.0 billion in January, on higher inventories of petroleum and coal product (+6.0%), machinery (+2.5%), beverage and tobacco (+6.0%), and fabricated metal product (+2.5%) industries. This was mainly attributable to higher prices for raw materials. Year over year, total inventories rose 19.4% in January.

The inventory-to-sales ratio increased from 1.60 in December to 1.62 in January. This ratio measures the time, in months, that would be required to exhaust inventories if sale were to remain at their current level.

Unfilled orders rise

The total value of unfilled orders rose 1.8% to $99.5 billion in January mostly due to higher unfilled orders of aerospace product and parts (+1.5%) and machinery (+5.1%).

Total value of new orders increased 1.1% to $66.6 billion in January, mainly attributable to higher new orders of petroleum and coal product (+8.7%). The increase was partially offset by lower new orders of motor vehicles (-16.3%).

Capacity utilization rate decreases on lower production

The capacity utilization rate (not seasonally adjusted) for the total manufacturing sector decreased from 75.7% in December to 74.1% in January on lower production.

The capacity utilization rate fell in 12 of 21 industries, driven by transportation equipment (-9.8 percentage points), primary metal (-4.1 percentage points) and non-metallic mineral product (-11.2 percentage points). Shutdowns at auto assembly plants were responsible for the decline in the capacity utilization rate of the transportation industry. The decline was partially offset by higher capacity utilization in the wood product industry (+6.6 percentage point).