Monthly Estimates of Business Openings and Closures, May 2021

August 30, 2021

There were slightly fewer active businesses (-0.1%; -1,208) in May compared with a month earlier, marking the first time since May 2020 that the number of closures outpaced openings.

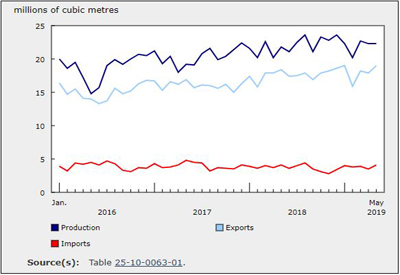

The number of business openings decreased by 11.5%, the largest percentage decrease since December 2018 and the second consecutive month with negative growth (Chart 1). The number of business closures declined by 2.9%, following a 2.5% increase in April.

The decline in the number of business openings in May was largely driven by fewer entrants (-16.4%). The number of entrants in May was below the 2015-to-2019 average for the first time since August 2020.

Reopenings also declined in May (-8.2%) and in April (-13.7%) and were lower than the 2015-to-2019 average for the first time since February 2020. This may have been due to the continuing third wave of the pandemic this May, when public health restrictions were tightened or introduced in several jurisdictions.

Nova Scotia (+17.7%; +144) was the only province with more business closures in May than in April. There were fewer business openings in every province and territory except Yukon, where openings increased slightly.

The number of active businesses in May was similar to the previous month in most provinces. Nova Scotia (-3.0%; -605) reported the largest variation in active businesses. After 11 consecutive months of positive growth, the number of active businesses decreased 0.9% (-36) in Prince Edward Island.

Fewest business openings in the tourism and accommodation and food services sectors on record

The number of business openings in the tourism (-48.2%; -1,622) and accommodation and food services (-29.1%; -720) sectors continued to decline in May, falling to their lowest level since the date series began in January 2015. The decline in business openings was widespread across all industries in May, driven by the broad-based decrease in reopenings and entries.

The change in the number of business closures varied across industries. For the first time since August 2020, accommodation and food services (-9.1%; -251) posted fewer business closures than the previous month. In contrast, business closures in arts, entertainment and recreation rose 6.3% (+44) following two months of negative growth.

The number of active businesses in the tourism sector declined for the second straight month, falling 0.9% (-625) in May, and remained 8.2% below its pre-pandemic level. The number of active businesses in the construction sector (-0.6%; -674) fell for the first time since May 2020. It was also the highest decrease among all industries.

For the first time since the spring of 2020, retail trade (-0.2%; -131) and arts, entertainment and recreation (-0.8%; -114) also had fewer active businesses than a month earlier. The number of active businesses declined for the second consecutive month in accommodation and food services (-0.6%; -339) and other services (-0.9%; -617).