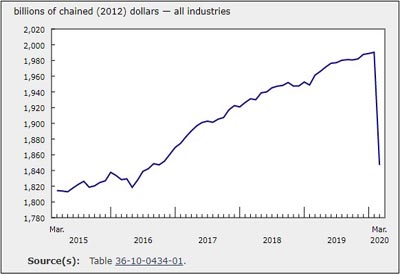

March GDP Dropped 7.2%

May 29, 2020

Real gross domestic product (GDP) dropped 7.2% in March. After the World Health Organization declared COVID-19 a pandemic on March 11, all levels of government in Canada put measures in place to slow its spread. Measures such as mandatory closures of non-essential businesses, schools and public institutions, and travel restrictions and physical distancing, combined with the closure of Canada’s international borders, affected all segments of the Canadian economy.

Overall, 19 of the 20 industrial sectors were down, contributing to the large monthly decline.

In light of the current unprecedented national and global economic environment, Statistics Canada is continuing to provide leading indicators of economic activity. Preliminary information indicates an 11% decline in real GDP in April. Given their preliminary nature, the April estimates will be revised as more information becomes available. Nonetheless, the March and April decreases are likely to be the largest consecutive monthly declines on record.

Accommodation and food services contract

The output of the accommodation and food services sector dropped by more than one-third (-36.9%) in March, as mandatory closures of all non-essential businesses in the second half of the month significantly affected industries in this sector. This is the largest monthly decline for the sector since the series started in 1961.

The food services and drinking places subsector fell 39.5%, as all types of restaurants and drinking places either closed completely in response to local and provincial states of emergency or remained open and adapted to provide take-out and delivery with varying degrees of success.

Accommodation services contracted 30.9% in March, as the restrictions on international and interprovincial travel drastically reduced the demand for these services.

Transportation and warehousing down sharply

After a 1.4% decline in February because of rail blockades, transportation and warehousing dropped 12.2% in March, as border closures and travel restrictions affected the sector. With the exception of rail transportation (+4.5%), all subsectors were down in the month.

Air transportation was the largest contributor to the decline, with a 40.9% contraction in March reflecting lower movement of both goods and passengers. International travel to and from Canada came to a standstill by the end of March as nearly all of Canada’s major carriers either completely suspended or significantly reduced their operations. A number of holiday-destination carriers focused their efforts in the latter part of the month on repatriating Canadians caught abroad following the sudden implementation of travel restrictions and border closures. WestJet cancelled all international flights and cut the number of domestic flights. Air Canada significantly reduced the number of domestic and US destinations and kept international connections in place at only six major airports to bring home Canadian residents and emergency supplies.

Transit and ground passenger transportation and scenic and sightseeing transportation fell 26.5%, as all industries were down. The 33.1% decrease in urban transit systems contributed the most to the decline, as ridership fell significantly in March.

Support activities for transportation (-12.1%) and truck transportation (-7.6%), despite being essential services, were down in March as a result of lower business activity and the closure of the Canada–US border on March 21 to all non-essential travel.

Rail transportation rose 4.5%, nearly offsetting the declines experienced in January and February, when weather delays and rail blockades affected the subsector.

Manufacturing sector drops

The manufacturing sector fell 6.5% in March to its lowest level since the second half of 2016, as many factories were shut down or faced sharply reduced demand during the second half of the month. The Monthly Survey of Manufacturing reported that over three-quarters (78.3%) of establishments in the manufacturing sector indicated that their activities were affected by COVID-19. Both durable and non-durable manufacturing were down as the vast majority of subsectors contracted.

Durable manufacturing dropped 11.1% as all subsectors fell. Transportation equipment manufacturing contributed the most to the drop, with a 21.1% decrease, as all industries recorded declines in March. The shuttering of automotive plants on both sides of the Canada–US border in response to the COVID-19 pandemic contributed to a decline in motor vehicle manufacturing (-35.2%) and motor vehicle parts manufacturing (-27.7%). Aerospace product and parts manufacturing was down 3.7%, reflecting lower demand from airlines for its products and services, as air travel and its short-term outlook became grim at the end of March.

Non-durable manufacturing decreased 1.1%, as the majority of subsectors declined. Plastic and rubber products manufacturing (-9.2%) and petroleum and coal product manufacturing (-7.9%) contributed the most to the decline. Refineries curtailed their production as global oversupply of oil and falling demand from motorists, airlines and other users drastically reduced the need (and price) for petroleum-based products. Increases in food manufacturing (+3.1%) and beverage and tobacco product manufacturing (+4.1%) offset some of the decline; demand at retailers for meat and dairy products, beer, wine, and soft drinks increased as consumers prepared for extended periods of self-isolation. The chemical manufacturing subsector rose 1.6%, largely as a result of a 12.9% gain in pharmaceutical and medicine manufacturing, responding to increased domestic and international demand. There was a 7.3% jump in the soap, cleaning compound and toilet preparation manufacturing industry, reflecting a surge in demand for household cleaning products such as bleach and hand sanitizers. Paper manufacturing was up 2.0% in response to panic-buying of sanitary paper products (paper towels, tissues, toilet paper, etc.) in March.

Retail trade down

Retail trade dropped 9.6%, the largest monthly decline since the series began in 1961, as 7 of the 12 subsectors were down. Motor vehicle and parts dealers contributed the most to the decline, with a 38.6% contraction in March. Excluding motor vehicle and parts dealers, retail trade would have shrunk by 3.2%. The output of clothing and clothing accessories stores (-52.4%) halved in March, as malls and stores were closed in response to mandatory lockdowns. Both home furnishings stores and sporting goods, hobby, book and music stores went down by nearly one-quarter. Despite consumers saving about 20 cents/litre on average at gasoline stations across the country in March, as reported by the Consumer Price Index, retailing activity at gasoline stations contracted 6.2%, as demand from motorists and businesses fell. By contrast, activity at food and beverage stores jumped 15.2%, the largest-ever monthly growth rate. Sales also rose 7.2% at non-store retailers, where panic-buying and self-isolation preparations by consumers, along with a shift to online shopping to maintain physical distancing, largely contributed to gains.

Public sector declines

The public sector (education, health care and public administration) fell 9.4% in March, as all three components were down in response to stay-at-home orders aimed at slowing the spread of COVID-19.

Health care services dropped 11.1%, as all types of health and social services were down. The 24.5% decrease in ambulatory healthcare services (services provided by offices of physicians, health practitioners, dentists, medical and diagnostic laboratories, etc.) contributed the most to the decline. Hospitals were down 1.9%, as hospitals across the country postponed all elective surgeries and procedures to make space for potential surges in COVID-19 patients.

Educational services fell 13.5%, with the steepest decline in elementary and secondary schools, as they dropped 19.7% following the suspension of classes by all provincial governments.

Public administration decreased 4.5% in March, as all levels of government instructed their employees to work from home where possible. Some hours of work were lost in transitioning to telework, while some services, such as libraries and community centres, were closed.

Personal and household services and repair services drop

Personal and laundry services (services provided by hair salons, beauty salons, funeral homes, laundry services, etc.) dropped 23.5%, while repair and maintenance decreased 15.5%. Private households (services provided by maids, cooks, gardeners, etc.) fell 38.3%, reflecting the mandatory closure of all non-essential businesses and services.

Finance and insurance sector down

The finance and insurance sector contracted 1.0% in March. The pandemic prompted a panicked sell-off across global stock markets, with the Toronto Stock Exchange (TSX) having to halt trading three times in eight days in March. The Standard and Poor’s / Toronto Stock Exchange composite experienced its worst single-day drop in March since 1987 and ended the month down 17.7%. At the same time, the Bank of Canada lowered the overnight lending rate three times in March.

These events on the stock markets led to an increase in activity as investors fled equities markets for safer assets. This flurry of activity saw the volume of trades on the TSX double in March and contributed to a 4.7% growth in financial investment services, funds and other financial vehicles. These gains were more than offset by an 8.0% contraction in insurance carriers and related services, and decreasing investment revenues and premiums contributed to the decline.

Arts, entertainment and recreation decline

The arts, entertainment and recreation sector fell 41.3% as amusement, gambling and recreation industries halted operations in response to the closure of institutions and restrictions on mass gatherings. The National Hockey League (as of March 12) and the National Basketball Association (as of March 11) suspended all scheduled games. As of March 13, about the same time, all minor and community-run sporting leagues that were active in March soon followed suit with mandated league shutdowns.

Construction sees the largest decline in more than a decade

Construction was down 4.4%, eclipsing the 3.3% contraction in January 2009. All subsectors declined, with residential construction (-3.8%), repair (-7.6%), and engineering and other construction (-3.2%) contributing the most.

Professional services down for the first time in more than two years

For the first time since October 2017, professional services were down, contracting 8.6% in March. All types of professional services, except for scientific research and development services (+2.3%), decreased, as numbers of hours worked across the sector declined significantly.

Wholesale trade declines

Wholesale trade contracted 5.1% in March, the largest decline since August 2003, as six of the nine subsectors were down. The closing of the Canada–USborder to non-essential travel paralyzed the cross-border interconnected supply and distribution channels that industries rely on.

Motor vehicle and motor vehicle parts and accessories merchant wholesalers (-20.4%) contributed the most to the decline in wholesale trade, as the shuttering of North America’s automotive assembly plants reduced the need for cross-border movement of parts and products between different production and assembly units. The personal and household goods merchant wholesaler subsector decreased 8.2%, as cumulative declines in many commodities sold in the subsector more than offset a large monthly increase in pharmaceuticals and pharmacy supplies merchant wholesalers, which was bolstered by domestic and international bulk purchasing of products. The building material and supplies merchant wholesaler subsector was down 7.3%, as construction activity in many provinces slowed or stopped altogether following state-of-emergency declarations. Food, beverage and tobacco merchant wholesalers rose 5.0%, the largest increase on record for the industry, reflecting increased demand for food products.

Mining, quarrying, and oil and gas extraction down

Mining, quarrying, and oil and gas extraction decreased 5.0%, largely as a result of a 26.9% decline in the support activities for mining, and oil and gas extraction subsector. Oil prices declined significantly through the month of March as a result of the decline in activities induced by COVID-19 and a worldwide oil supply glut.

Mining excluding oil and gas extraction declined 1.9%, as the 16.5% growth in coal mining was more than offset by a 4.9% contraction in metal ore mining and a 1.0% decrease in non-metallic mineral mining.

Real estate sector declines in March

Real estate was down 1.0% in March. Activity at the offices of real estate agents and brokers fell 16.4% in March as home resale activity in nearly all major centres came to a halt in the second half of the month in response to stay-at-home orders.

First quarter of 2020

The value added of goods-producing industries was down for the third quarter in a row, declining 1.1%. Services-producing industries were down 2.4%, declining for the first time since the first quarter of 2009. Overall, there were losses across all industrial sectors, except real estate and rental and leasing.

The main contributor to the decline in goods-producing industries was manufacturing (-2.1%), contracting for the fourth quarter in a row. Durable manufacturing declined 4.2%. The bulk of the decrease came from lower transportation equipment manufacturing (-10.9%), as temporary plant shutdowns at some automotive assembly plants and the closure of the GM plant in Oshawa in December 2019 contributed to the decline. Non-durable manufacturing was up 0.4%, largely because of increases in food manufacturing (+3.5%) and beverage and tobacco product manufacturing (+8.8%).

Among services-producing industries, the primary contributor was the public sector (-3.1%), as all its components decreased. Declines were largest in educational services (-6.1%) and health care and social assistance (-3.0%). Educational services saw rotating teacher strikes in Ontario mostly in the first two months of the quarter, along with school closures across Canada in the second half of March. The accommodation and food services sector dropped 13.1% in the quarter, as mandatory closures for non-essential businesses were put in place in the second half of March because of the COVID-19 pandemic.

Transportation and warehousing declined 5.2% in the first quarter. Border closures and travel restrictions across Canada in March led to significant declines in air transportation (-16.9%); support activities for transportation (-6.2%); truck transportation (-4.3%); and transit and ground passenger transportation and scenic and sightseeing transportation (-8.6%).

The arts, entertainment and recreation sector was down 14.3% in the quarter. Performing arts, spectator sports and related industries, and heritage institutions (-15.8%), as well as amusement, gambling and recreation industries (-12.9%), stalled in the second half of March. Professional, scientific and technical services retreated 2.2%, the first quarterly decline since the third quarter of 2015. Declines in retail trade (-2.4%) were led by clothing and clothing accessories stores (-18.1%) and motor vehicle and parts dealers (-10.1%). The administrative and support, waste management and remediation services sector was also affected, declining 4.5% in the first quarter, as all subsectors were down.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/200529/dq200529b-eng.htm?CMP=mstatcan