Looking Forward for 2021

Jan 10, 2021

By David Gordon

January 1 marked the turning of the calendar and with it we think “a new year.” 2020 was an interesting year. Few, if any, recall the first 75 days of 2020 and the promise, or concerns, that ushered in the year. 2020 will be considered, forevermore, the year of COVID and the year started in mid-March.

2020 was a year of challenge and opportunity. Concern of a calamity to a year that had a modest decline for many and opportunity for some. A time when companies reacted and then acted. Where flexibility, adaptability and innovation became hallmarks of survival and success. When leaders led and inspired their teams. It may be looked upon as a turning point year. We know that tomorrow will not be like today, but we will not be going back to yesterday. Tomorrow’s strategies will leverage the best of today, the best of yesteryear, and capitalize on new opportunities as companies adapt to a different environment.

Part of this “new” environment will consist of changing work environments, differing sales approaches, customers “released” from milk-run salespeople (and strategies), air travel for purpose rather than perfunctory “touchbase” meetings, increased usage of technology throughout commerce. An environment where relationships matter but companies (and people) need to perform.

And more. In other words, COVID will inevitably accelerate what was going to occur over multiple years into a more compressed timeframe. Speed, strategy, talent, ideas, systems, financial strength and vision will differentiate companies.

COVID as a teacher

COVID has taught much. And for those with the long-term viewpoint, much positive can be found.

With this as a backdrop (or perhaps another way of saying this is “with time to reflect over the holiday break”), here are 10 areas to consider in 2021 (not in any order of importance).

Rather than make specific predictions, we focused on 2021 trends. Companies that are able to capitalize on most of these issues will position themselves for accelerated growth.

1. Data analytics. We’ve already heard much about it and many companies are pitching it. Data analytics is important to you but recognize that too much creates paralysis. If you can’t act on it, don’t worry about acquiring it (paying for it). There are only so many dashboards you and your team can look at (and act on). Data analytics is like leads. It’s great to have lots of them but if you don’t have systems, people or time, you cannot execute on all of them (or maybe even differentiate between qualified and unqualified). Sometimes less is more as the issue isn’t quantity, it’s quality. But, to have a 2021 growth strategy you need some analytics to enable you to know 1) your share and 2) your share by account. With these two data points you can map corporate strategy as well as account strategy.

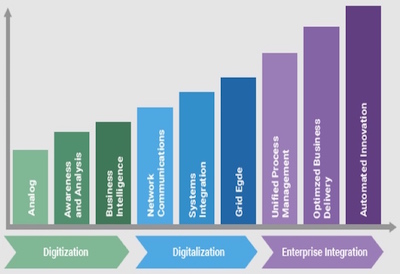

2. eCommerce. As a broad term, it will continue to grow in importance as it streamlines information flow and can automate transactions. eCommerce is an element of “digital transformation.” Customers want you to have omni-service capabilities so they can interact with you when they want to, as they need to. This digital transformation is applicable for distributors, manufacturer reps and manufacturers. A key is understanding customer wants (as well as determining if they are satisfied with your current offering). But access to people is still important.

3. Supply chain disruption. Expect continued supply chain issues, especially for products coming from Asia and India. Why? Lack of vaccine in underdeveloped/large population countries. If they can’t vaccinate manufacturing environments in 2021, offshore manufacturing could face disruption. And this could expand to shipping. Locally manufactured products, competitively priced, could see increased opportunities.

4. Training continues to evolve. Zoom/Teams became the definition of training of 2020 but effectiveness for some roles is diminishing. The issue isn’t the medium, it’s more about understanding that the goal of training is learning. People learn via different styles — audio, visual, kinetic and via osmosis (understanding from applications). Repetition is needed to embed the content into an individual’s memory. And different roles consume information differently. Companies will continue to evolve and will need to re-evaluate their solutions. 2020 training won’t work in 2021 as teams become zoomed out.

5. Power. The electrical industry will be faced with new growth opportunities brought about by the new US administration. Given President Biden’s appointments and initiatives it is clear that climate change and renewable energies will receive funding. This creates opportunities distributors, manufacturer reps and manufacturers should start to consider. Solar, wind, micro-grid, electric vehicles, batteries and more will create opportunities. Some electrical distributors will reconsider themselves as power distributors… offering solutions for any power source.

6. Marketing. Investing in marketing is more important than ever as it provides an additional, and in some cases an alternative, means of reaching customers. Marketing is about the message to the customer (“why you”), the medium (digital, print, personal, video, etc.) to get to the customer, building a brand, targeting messaging, research, strategy support and more. It hasn’t been “promotions, events and premiums” for a long time. It is integral to success. Marketing is a revenue generator and a differentiator. Companies with a commitment to marketing, that have integrated it into the essence of their organization, outperform others.

7. Acquisitions. Plan on more in 2021. Many manufacturers are seeking growth through acquisition, which inevitably will help acquirers diversify into other product categories. There will be some Rockwell distributors merge (or acquisitions occur). Other distributor and manufacturer rep acquisitions will occur due to lack of succession within companies (either no next generation, qualified employees to lead an ESOP or be funded by banks to acquire the business).

8. Loyalty. Loyalty was on display in 2020 as evidenced by customers preferring to do business with existing suppliers whenever possible. Change is difficult and there is comfort in doing business with trusted resources… provided that they perform. Loyalty isn’t about rebates or points. It’s about performance and relationships. Business must be earned, repeatedly. Distributors should not “pay” customers to do business with them, but they should consider incenting them to do more business with them to take share. A well-structured incentive program can be the central point of an integrated marketing strategy that communicates to core customer segments that drive results from mid-sized customers (consider 5-100 person contractor shops) and other environments where decision-makers can become invested. Leading programs are also identifying ways to invest in their customers and communities while some rely on the tried and true merchandise rewards. Incentive programs are about share and topline and bottom-line growth. And a growing customer is the definition of loyalty.

9. Role of salespeople. Relationships matter. In fact, customers prefer to do business with trusted organizations, and this starts with their first point of contact — a salesperson. Each role in sales plays a part. The lone wolf salesperson from yesteryear is being replaced with sales teams at the request of customers… because they need more sales support… more expertise. Salespeople must be more adept technically and technologically. They must be listeners, questioners and solution provider. But they also must be empathetic and strategic. They need to know how to use the right data to capture share within their territory and account while selling the value of the company. And salespeople need to “sell” as in “incremental performance” be it sales and/or new accounts. Alternatively, they are account managers or “team leader” for an account… different compensation models. In 2021, more companies will re-evaluate their sales models. Increased costs (personnel) with same performance doesn’t work. (And on a separate note, does “inside sales” need to be rethought into “customer service” and “business development” as most “inside salespeople” only occasionally generate an ancillary sale through an add-on? Perhaps expectations change if the role is segmented?)

10. Pricing. Profitability is driven by two things: the margin that is added to your cost of goods sold (COGS) and your cost of operations. Your margin is derived from market competition and the value that the customer perceives in doing business with you. Inevitably the margin is defined, at a minimum, by your pricing strategy. Believing you are worthy of a premium is a first step to receiving one. Functionally, a strategic approach to pricing is critical to profitability and the ability to invest. Some keys include utilization and capitalization on SPAs, dramatically reducing overrides, recognizing margin is not restricted to whole digits, understanding your market as well as your internal comparables and not handing the keys to the inmates (your salesforce). Top performing companies have pricing strategies… and higher gross margins which results in higher net profits.

We know 2021 will have its own challenges and COVID will continue to be one of them. But there is an air of optimism that there is light at the end of the tunnel. It will take some time, but this “time” represents an opportunity to evaluate and accelerate plan that will help you take share and accelerate profitable growth.

May you have a happy and healthy 2021.

David Gordon is President of Channel Marketing Group. Channel Marketing Group develops market share and growth strategies for manufacturers and distributors and develops market research. CMG’s specialty is the electrical industry. He also authors an electrical industry blog, www.electricaltrends.com. Channel Marketing Group does not engage with clients on detailed pricing strategies, however, given that pricing is a critical element of sales, marketing and growth planning, we do get asked about the topic and can share opinions and refer to those who focus on the area as well as share anecdotes. David Gordon can be reached at 919-488-8635 or dgordon@channelmkt.com.