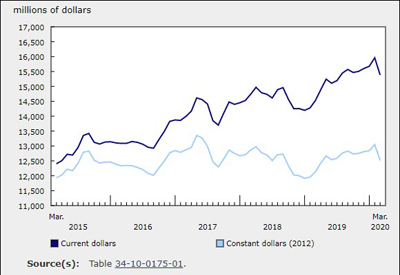

Investment in Building Construction Rose 1.8% in July

Sept 24, 2020

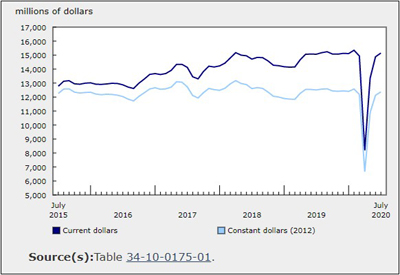

Total investment in building construction increased 1.8% to $15.1 billion in July. Residential sector investment increased 4.9% to $9.9 billion, while non-residential investment decreased 3.7% to $5.3 billion. Construction activity has rebounded in the last few months, with investment in building construction remaining slightly lower than February 2020 levels, before COVID-19 construction restrictions were first put in place. On a constant dollar basis (2012=100), investment in building construction increased 2.0% to $12.4 billion.

Residential construction up for the third consecutive month

Investment in residential construction rose 4.9% to $9.9 billion in July, with increases in both single-unit (+7.5% to $5.1 billion) and multi-unit (+2.4% to $4.8 billion) investment. Ontario (+4.5% to $4.0 billion) and Quebec (+5.6% to $2.0 billion) led all of Canada in residential gains.

Despite another month of residential growth, national investment was 3.7% lower than the pre-COVID-19 levels observed in February 2020. Quebec had the largest gap between current and pre-COVID-19 levels, down $249.6 million or 10.9% compared with February 2020.

Non-residential investment pulls back

Following strong gains in June, non-residential construction investment declined 3.7% to $5.3 billion in July, with decreases reported in all three components. Eight provinces reported declines for the month, with the largest decreases in Ontario (-3.2% to $2.1 billion) and Quebec (-4.8% to $1.4 billion). Newfoundland and Labrador (+4.2%) and Prince Edward Island (+4.1%) were the only provinces to report gains for the month. Further declines are anticipated in this sector as many office buildings and shopping malls remain under-utilized.

The commercial component represented the majority of non-residential declines, down 5.0% to $3.1 billion in July. Nine provinces reported declines for the month, while Prince Edward Island reported an increase of 29.2% to $7.1 million. The largest declines were reported in Quebec (-7.8%) and Ontario (-3.9%), although both provinces remained above pre-COVID-19 levels. Declines in those provinces were attributed to a combination of fewer new construction starts, and several major projects winding down to completion.

The institutional component of non-residential investment decreased 0.8% to $1.2 billion in July. Quebec reported the majority of declines for the month, more than offsetting gains in British Columbia and Newfoundland and Labrador.

Nationally, the industrial component was down 2.8% in July. Eight provinces reported declines, with the largest decrease in Ontario, down 4.2% to $369.5 million.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/200921/dq200921a-eng.htm