Investment in Building Construction Rebounded 6.7% in January

Apr 1, 2019

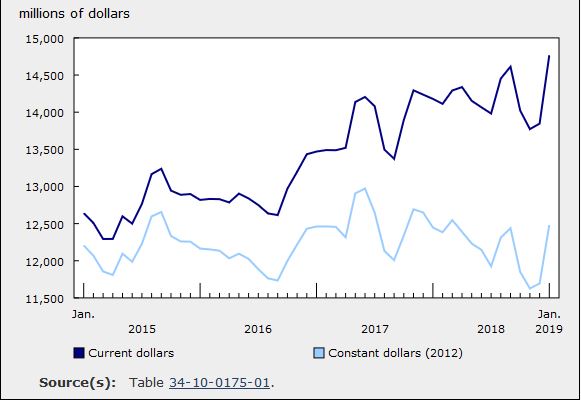

Total investment in building construction rebounded in January, up 6.7% from December to $14.8 billion. Gains in the residential sector (+9.0% to $10.4 billion) led investment for the month, as the non-residential sector continued to moderate the overall rate of investment in building construction (+1.5% to $4.4 billion). On a constant dollar basis (2012=100), investment in building construction also rose 6.7% to $12.5 billion.

Investment in residential building construction

The increase in total residential investment in January was broad based, with every province and territory increasing except Nunavut (-14.6%). Gains for the month were led by Ontario (+$277 million), Quebec (+$236 million) and Alberta (+$115 million).

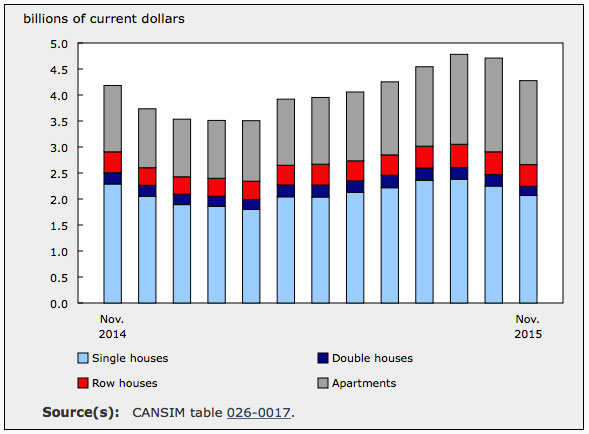

In the residential sector, investment in single-dwelling construction broke from the downward trend set over the last three months of 2018, up 10.6% in January to $5.4 billion. At the same time, investment in multiple dwelling construction, which includes doubles, row homes, and condo and rental apartments, continued to build its upward momentum, rising 7.2% to $5.0 billion.

Residential investment in focus: Montreal, Toronto and Vancouver

On an unadjusted basis, Canada’s three largest municipalities posted strong year-over-year growth in total residential investment (Montreal +26.1%, Vancouver +18.1%, Toronto +8.6%) in January.

This growth was primarily concentrated in the multiple dwelling component, as builders focused investment in the construction of new condo and rental apartments (Toronto +$140 million, Vancouver +$139 million, Montreal +$79 million).

At the same time, while each of the major metropolitan centres saw lower investment in the construction of new single family homes (Toronto -$140 million, Vancouver -$63 million, Montreal -$6 million), the renovation market mostly offset that weakness (Toronto +$126 million, Montreal +$91 million, Vancouver +$18 million).

Investment in non-residential building construction

Gains in the non-residential sector in January were concentrated primarily in Quebec (+$36 million) and British Columbia (+$23 million). Investment in the remaining provinces and territories rose by $8 million to $2.8 billion.

By component, the gain in January was attributable to a 2.8% increase in investment in commercial buildings, reaching a record high $2.5 billion for the monthly series. The industrial component edged up 0.5% to $831 million, which was offset by a corresponding small decline in institutional investment (-0.7% to $1.0 billion).

Non-residential investment in focus: Montreal, Toronto and Vancouver

By contrast, the picture for non-residential investment was more varied than in the residential sector. On an unadjusted basis, total non-residential investment in Montreal rose 10.4% year over year in January to $547 million, on gains in the commercial (+$33 million) and industrial (+$17 million) components.

Toronto saw a significant decline in the non-residential sector (-17.8%), with all three components down in January compared with the same month a year earlier. The downward movement in investment was mainly the result of a $130 million decline in institutional spending due to maturing hospital projects (Mackenzie Vaughan and Mount Sinai), followed by declines in industrial (-$28 million) and commercial (-$28 million) investment.

On the West Coast, non-residential investment in Vancouver rose 22.9% on strength in the commercial component (+$90 million), which was partially offset by small declines in institutional (-$8 million) and industrial (-$7 million) investment.

Source: Statistics Canada, https://www150.statcan.gc.ca/n1/daily-quotidien/190321/dq190321c-eng.htm