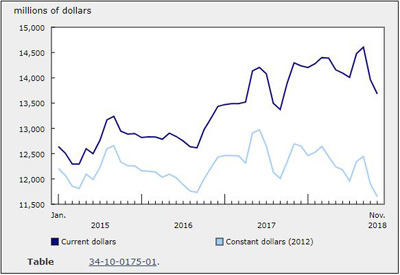

Investment in Building Construction Dipped 2% in November

Jan 22, 2020

Total investment in building construction decreased 2.0% from October to $13.7 billion in November. Both the residential (-2.2% to $9.4 billion) and non-residential (-1.6% to $4.3 billion) sectors declined. On a constant dollar basis (2012=100), investment in building construction decreased 2.1% to $11.6 billion.

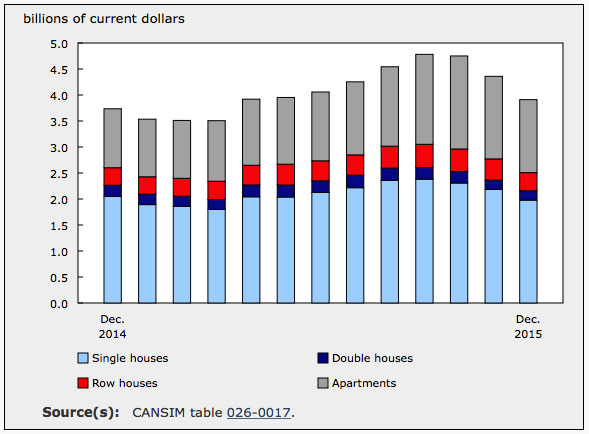

In the residential sector, investment in single dwelling construction was down 2.0% to $4.9 billion, while investment in multiple dwelling construction (which includes doubles, row homes and apartments) declined 2.5% to $4.5 billion.

Investment in residential construction by type of work

Detailed data on investment in building construction by type of work is only available on an unadjusted current dollar basis.

Market share for investment in residential building construction by type of work (excluding minor permits) for November was 48.7% new construction, 48.2% renovations, 1.6% conversions and 1.5% other types of work. The other types of work component include deconversions, garages and carports, as well as in-ground swimming pools. While the long-term split between the types of work is fairly stable, there is a highly seasonal pattern in market share for renovations and new construction, with the renovation market reaching a low point in the middle of winter (January and February).

Based on type of work, investment in new construction for single dwellings fell 18.5% from November 2017 to $1.9 billion. This decline was partially offset by an 11.1% year-over-year increase in new construction for multiple dwellings to $3.0 billion.

In comparison, investment in renovations for single dwellings declined 2.5% to $3.3 billion year over year, while investment in renovations for multiple dwellings fell 21.5% to $1.6 billion.

Investment in non-residential building construction

The decrease in investment in the non-residential sector was broad based, with eight provinces posting declines, while Newfoundland and Labrador (+6.0% to $51 million) and British Columbia (+0.3% to $571 million) reported increases.

Investment in each of the three non-residential sectors fell, with the institutional sector (-2.8% to $1.0 billion) posting the largest decline.

Investment in non-residential construction by type of work

New construction accounted for almost half of investment in non-residential building construction (48.9%), while renovations accounted for 38.6% and other types of work represented the balance of investment at 12.5%, mainly deconversions. While the share of investment in other types of work has remained relatively stable, investment in new construction within the non-residential sector has declined as a share of total investment in the sector since the start of the series in January 2015. Conversely, renovations as a share of total non-residential construction investment have continued to increase to offset this decline.

Based on type of work for non-residential construction in November, the year-over-year investment value declined more sharply in new construction (-3.4% to $2.1 billion) than in renovations (-2.5% to $1.7 billion). Meanwhile, other types of work edged down 0.6% to $544 million.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/190121/dq190121a-eng.htm