Gross Domestic Product by Industry, March 2022

June 6, 2022

Real gross domestic product (GDP) rose 0.7% in March, following a 0.9% expansion in February. Broad-based increases across most sectors were led by client-facing industries.

Both services-producing (+0.6%) and goods-producing (+0.9%) industries were up, as 14 of 20 industrial sectors expanded in March.

Advance information indicates that real GDP increased 0.2% in April. Output was up in the mining, quarrying and oil and gas, transportation and warehousing and wholesale trade sectors. Notable decreases were recorded in the real estate and rental and leasing, finance and insurance, manufacturing and construction sectors. Owing to its preliminary nature, this estimate will be updated on June 30 with the release of the official GDP data for April.

Client-facing industries continue to lead the growth, benefiting from easing of public health restrictions

In March, the client-facing industries continued to recover ground lost in December 2021 and January 2022 when public health measures were put in place to dampen the spread of the Omicron variant.

Accommodation and food services continue to grow

Following a 14.3% jump in February, the accommodation and food services sector rose 10.9% in March as both subsectors were up.

Food services and drinking places (+8.5%) led the growth in March as capacity restrictions continued to be lifted and the proof of COVID-19 vaccination requirements were eliminated across several provinces during the month.

Accommodation services rose 17.3% in March, up for a second consecutive month. Traveller accommodation services led the growth, lifted by a higher number of domestic and international travellers in the month.

Transportation and warehousing keeps rolling

Transportation and warehousing rose 3.2% in March, following a 2.4% growth in February, as 8 of 10 subsectors were up.

Air transportation jumped 57.2% in March as airlines carried more goods and passengers. The lifting of restrictions on international arrivals’ landing ports along with pent-up demand for March break travel by the general public all positively contributed to the spike in activity.

Support activities rose 2.6% in March, up for a fifth time in six months, on a broad-based growth across most industries as only support activities for rail were down in the month.

Transit, ground passenger, and scenic and sightseeing transportation expanded 3.0% in March, up for the second month in a row, benefiting from an increase in public transit ridership.

Pipeline transportation increased 1.8%, the highest monthly growth rate since November 2020, as pipeline movement of natural gas and crude oil and other transportation both rose in March 2022.

Arts, entertainment and recreation performs well in March

The arts, entertainment and recreation sector increased 13.5% in March, the largest growth rate since July 2020, as many spectator sport venues, recreation centres and casinos allowed more patrons to attend their facilities.

Amusement, gambling and recreation industries (+14.7%) contributed the most to the growth in March as higher activity at casinos, bingo halls and other gaming terminals led the increase.

Performing arts, spectator sports and related industries, and heritage institutions grew 11.9% in March as attendance at professional sporting and performing arts events increased.

Construction up, building upon two months of growth

The construction sector rose 1.2% in March, with output surpassing April 2021 to reach an all-time high, with all subsectors contributing to the growth.

In March, residential building construction (+1.8%) led the growth for the third month in a row, with home alterations and improvements and construction of single-detached homes contributing the most to the increase during the month.

Non-residential building construction rose 0.9% in March, up for the ninth consecutive month. All construction activities posted gains with commercial building construction contributing the most to the increase, driven in part by a retail development in Mount Royal, Quebec.

Engineering and other construction activities increased 0.6% in March, continuing an upward trend that began at the end of 2020 and is 1.9% below February 2020’s pre-pandemic level of activity. Repair construction rose 1.2% in March 2022, up for the seventh time in eight months, as both the residential and non-residential segments expanded.

Strength in manufacturing continues

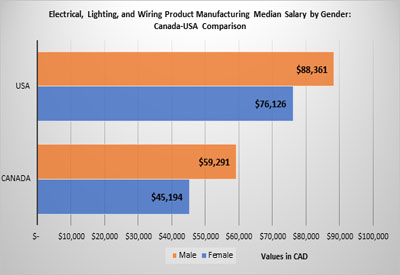

Manufacturing rose 0.9% in March, surpassing the February 2020 pre-pandemic level of activity. Increases in both durable and non-durable goods manufacturing contributed to the sixth consecutive monthly expansion in the sector.

Durable goods manufacturing grew 1.2% in March as 6 of 10 subsectors were up. Transportation equipment manufacturing contributed the most to the growth as activity at motor vehicle (+8.8%) and motor vehicle parts (+6.7%) plants was less affected by the semiconductor chip related shortages in March. The computer and electronic products manufacturing subsector rose 8.4%, as all industries were up, while furniture and related products (-3.9%) and primary metal manufacturing (-1.5%) offset some of the growth.

Non-durable goods manufacturing grew 0.5% as five of nine subsectors were up in March. Leading the growth were plastics and rubber products (+5.5%), partly due to higher demand from motor vehicle and motor vehicle parts manufacturers, and food manufacturing (+1.3%) as the majority of industries expanded. Chemical manufacturing contracted 1.7%, reflecting lower pharmaceutical manufacturing (-9.8%) following a period of elevated activity.

Mining, quarrying and oil and gas extraction continues to grow

The mining, quarrying and oil and gas extraction sector rose 1.4% in March as all subsectors posted gains.

Oil and gas extraction expanded 1.7% in March, rising for the second month in a row after three months of decline. Oil sands extraction grew 2.3% in March, following a 2.0% growth in February, led by continued increases in crude bitumen and synthetic crude production in Alberta. Oil and gas extraction (except oil sands) rose 0.9% as growth in crude petroleum extraction more than offset lower natural gas extraction.

Mining and quarrying (except oil and gas) increased 0.9% in March, as growth in metal ore mining more than offset declines in the other two subsectors.

Metal ore mining increased 4.4% in March, rising for the second month in a row, as all types of metal ore mining grew, led by gold and silver ore mining along with iron ore mining. Non-metallic mineral mining and quarrying was down 1.7%, with potash mining contributing the most to the decline.

Coal mining contracted 5.6% in March following three months of strong growth. The elevated production in the previous three months was an effort by producers to make up for deliveries affected by flooding in British Columbia in late 2021.

Support activities for mining, and oil and gas extraction increased 0.8% in March 2022 on account of an increase in drilling and rigging services.

Finance and insurance up as global instability creates market volatility

The finance and insurance sector increased 0.4% in March, up for a 10th month in a row, on a broad-based growth across the sector. The escalating conflict in Ukraine and the isolation of Russia from the global financial markets, contributed in part towards an unprecedented net inflow of funds in the Canadian economy in March, as the value of traded activity on the Toronto Stock Exchange climbed to the highest level since March 2020.

Financial investment services, funds and other financial vehicles rose at its fastest pace since November 2020, up 2.1% in March 2022.

Wholesale trade declines

Wholesale trade contracted 0.7% in March, down for the third month in a row, as five of nine subsectors were down.

Machinery, equipment and supplies wholesaling (-3.9%) contributed the most to the decline in March, as all industries comprising the subsector were down. Farm products wholesaling contracted 15.1% in March as lower output of grain and oilseed dealers was reflected in lower exports of canola and other grains as supplies dwindled following a drought-stricken 2021 harvest.

Miscellaneous wholesaling (+4.2%) rose for the second month in a row, and building materials and supplies wholesaling expanded 1.7% in March, benefiting from an increase in construction activity.

Retail activity shrinks for the second month in a row

The retail trade sector contracted 0.6% in March, down for the second month in a row, as a decline in the motor vehicle and parts dealers subsector more than offset gains in the majority of other subsectors. Excluding motor vehicle and parts dealers, retail trade rose 0.7%. Motor vehicle and parts dealers dropped 7.7%, the largest monthly decline since December 2020, as activity at dealers’ lots dipped for the second month in a row.

First quarter of 2022: A quarter of two tales

Economic activity expanded 0.8% in the first quarter of 2022, representing a third consecutive quarterly gain. Goods-producing sectors, specifically construction, manufacturing and agriculture, forestry, fishing and hunting, were among the largest contributors to growth, as all continued to rebound for a second consecutive quarter from declines recorded earlier in the course of 2021. Several client-facing service industries were detractors to growth in the first quarter of 2022, in large part due to the impact of restrictions that were introduced or tightened in December 2021 and January 2022 to curb the spread of the Omicron variant.

Most goods-producing sectors contributed to growth in the first quarter

Construction expanded 3.3% in the first quarter with gains across all subsectors. Residential building construction (+3.9%) was a significant contributor to growth, rebounding from the declines recorded in the previous two quarters, although still sitting 5.5% below its peak observed in the second quarter of 2021.

The manufacturing sector rose 1.9% in the first quarter of 2022, with transportation equipment manufacturing driving the gains for a second quarter in a row. Motor vehicle and parts manufacturing led growth as supply-chain issues and semi-conductor shortages abated in the Canadian market in the second half of the quarter and exports rose. Other transportation equipment manufacturing also grew strongly in the quarter.

Agriculture, forestry, fishing and hunting expanded 5.8% in the first quarter, as activity related to crop production continued to rebound following the low output levels from the 2021 harvest that were a result of record-setting heat, drought and forest fires in Western Canada.

Detracting from the growth in goods-producing industries was the mining and quarrying and oil and gas extraction sector (-2.3%), as colder than usual temperatures, COVID-19 outbreaks, limited personnel and maintenance activities at oil sands facilities affected production.

COVID-19 limits growth for client-facing industries

Accommodation and food services (-1.2%) and arts, entertainment and recreation (-0.8%) recorded declines in the first quarter, despite gains observed in February and March as COVID-19 restrictions were loosened.

However, transportation and warehousing (+0.2%) was able to post a slight increase in the first quarter in large part due to the rebound observed at the end of the quarter as some international travel restrictions were loosened.

Professional, scientific and technical services (+1.9%), up for a seventh consecutive quarter, were the strongest contributor to growth in services-producing industries in the first quarter of 2022. Computer systems and related services, which also expanded for a seventh consecutive quarter, led growth over that period.