Gross Domestic Product by Industry, May 2025

August 6, 2025

Real gross domestic product (GDP) edged down 0.1% in May for the second consecutive month, as goods-producing industries declined while services-producing industries were essentially unchanged.

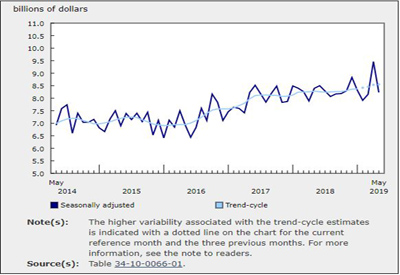

Chart 1

Real gross domestic product edges down in May for the second consecutive month

The goods-producing industries edged down in May, driven primarily by a contraction in the mining, quarrying and oil and gas extraction sector, while the manufacturing sector expanded in the month. The services-producing industries were essentially unchanged, as real estate, rental and leasing and transportation and warehousing posted increases while retail trade and public administration contracted. Overall, 7 of 20 industrial sectors expanded in May.

Activity in the manufacturing sector increases in May after contracting in April

The manufacturing sector grew 0.7% in May, partially offsetting April’s 1.8% decline, as higher inventory accumulation largely contributed to the growth. This was the third increase for the sector in five months, with increases recorded in both durable and non-durable goods manufacturing in May. Activity in the manufacturing sector was 1.1% below the March level, the month when US tariffs on Canadian goods officially took effect.

Chart 2

Manufacturing sector rises in May

Durable goods manufacturing industries (+1.2%) rose for the fourth time in five months, as 8 of 10 subsectors expanded in May, led by increased activity in the fabricated metal product manufacturing subsector (+2.8%), which rebounded from the previous month’s decline. The machinery manufacturing subsector (-1.7%) tempered the growth in May, posting its fourth decline in five months and bringing activity to its lowest level since March 2022.

Non-durable goods manufacturing industries (+0.2%) increased following two consecutive monthly declines, as activity in most subsectors expanded in May. The chemical manufacturing subsector (+3.2%) led the growth, driven by the pharmaceutical and medicine manufacturing industry (+8.0%) which posted a second consecutive monthly increase. Petroleum refineries (-4.9%) tempered the increase in the non-durable goods manufacturing aggregate in May, since many refining facilities were undergoing maintenance and retooling throughout the month.

Transportation and warehousing up on widespread expansions

Transportation and warehousing increased 0.6% in May, coming off a 0.1% decline in April, as most subsectors expanded in May.

Chart 3

Rail transportation rises in May

Rail transportation (+1.9%) contributed the most to growth in May as volume and tonnage increased. Intermodal and non-intermodal carloadings increased, after April’s broad-based declines, which were attributed to lower freight movement with US connections.

Pipeline transportation rose 1.3% in May. Higher transportation of crude oil and other pipeline transportation (+1.8%) led the increase following a successful restart to a pipeline that suffered a rupture and a spill in April. Pipeline transportation of natural gas rose 0.9%.

Transit, ground passenger, scenic and sightseeing transportation rose 0.8% in May, more than offsetting the decline recorded in April and driven by an increase in urban transit systems (+1.0%).

Real estate and rental and leasing up on higher activity in home resale market

Real estate and rental and leasing grew for the second consecutive month, rising 0.3% in May.

Activity at the offices of real estate agents and brokers and activities related to real estate (+3.5%) posted a second consecutive increase, reflecting higher home resale activity across the country in May, led by the Greater Toronto Area. The two consecutive increases in the industry partially offset the declines recorded in the previous four months.

Legal services, which derives much of its activity from real estate transactions, rose 0.5% in May.

Retail trade down as lower activity at motor vehicle and parts stores weighs on sales

The retail trade sector contracted 1.2% in May, as activity in 7 of 12 subsectors decreased.

Chart 4

Retail trade sector contracts in May

Motor vehicle and parts dealers (-4.8%) contributed the most to the monthly decline, reflecting lower activity for new and used car dealers and partially offsetting the increases recorded in the previous two months. The subsector was on an upward trend during most of the second half of 2024. Despite posting its third decline in five months in 2025, the activity in May 2025 was 7.8% above the June 2024 level.

Food and beverage stores (-2.5%) and gasoline stations (-3.1%) further contributed to the decline in retailing activity in May.

Mining, quarrying, and oil and gas extraction sector down

The mining, quarrying and oil and gas extraction sector contracted 1.0%, following two consecutive monthly increases, as most subsectors declined in May.

The mining and quarrying (except oil and gas) subsector was down 2.1% in May, as all industry groups contracted on broad-based declines across the industries.

The oil and gas extraction subsector contracted 0.8% in May, posting its first back-to-back monthly declines since April and May 2023. Oil sands extraction contracted 3.0% in May, driven by lower crude bitumen extraction as well as lower synthetic crude production as several oil extraction and upgrading facilities in Alberta continued maintenance and turnaround work throughout the month. Meanwhile, oil and gas extraction (except oil sands) rose 1.5%, reflecting higher activity in natural gas and crude petroleum extractions.

Public sector down in May, following increased activity in April largely due to the Canadian federal election

The public sector aggregate (comprising educational services, health care and social assistance, and public administration) was down 0.2% in May, following two consecutive monthly increases. The public administration sector (-0.8%) drove the decline in May as federal government public administration (except defence) contracted 3.2%, following the increased activity in April associated with the Canadian federal election.

The health care and social assistance sector rose 0.2% in May, with broad-based increases across all subsectors, while the educational services sector edged up 0.1%.

Arts, entertainment and recreation sector up as three Canadian National Hockey League teams qualify for the second round of the playoffs

The arts, entertainment and recreation sector increased 0.2% in May, a third consecutive increase, driven in large part by performing arts, spectator sports and related industries, and heritage institutions (+1.2%). For the first time since 2004, three Canadian National Hockey League teams qualified for the second round of the playoffs, resulting in a higher than usual number of games taking place in Canada in May and contributing to increased activity in spectators’ sports in the month.

Chart 5

Main industrial sectors’ contribution to the percent change in gross domestic product in May

Advance estimate for real gross domestic product by industry for June 2025

Advance information indicates that real GDP increased 0.1% in June. Increases in retail trade and wholesale trade were partially offset by a decrease in manufacturing. Owing to its preliminary nature, this estimate will be updated on August 29, 2025, with the release of the official GDP by industry data for June.

With this advance estimate for June, information on real GDP by industry suggests that the economy was essentially unchanged in the second quarter of 2025. The official estimate for the second quarter will be available on August 29, 2025, when the official estimate of GDP by income and expenditure is released.