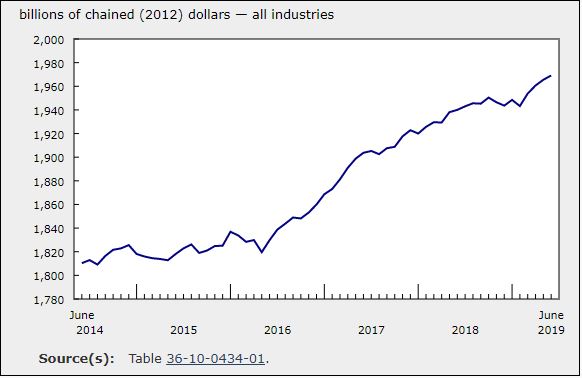

GDP Rose in June for the 4th Month; Wholesale Trade Up 0.9%

Sept 11, 2019

Real gross domestic product was up for the fourth consecutive month in June, rising 0.2%. Growth in 17 of 20 industrial sectors more than compensated for a decline in manufacturing.

Goods-producing industries declined 0.2% as a result of lower manufacturing, largely offsetting the growth in May. Services-producing industries were up 0.3%.

Construction sector increases

The construction sector was up 0.7% in June, the third increase in four months. Residential construction grew 1.2% due to increases in single-unit construction and home alterations and improvements. Non-residential construction (+1.0%) rose for the sixth time in seven months. Repair construction expanded 1.3%, while engineering and other construction decreased 0.4%.

Wholesale trade up for the fifth time in six months

The wholesale trade sector was up for the fifth time in six months in June, increasing 0.9% and partially offsetting the 1.6% decline in May. Seven of nine subsectors increased, led by miscellaneous wholesaling (+3.8%) and machinery, equipment and supplies (+1.0%). Building materials and supplies (-0.5%) were down for the first time in four months, as two of the three industries comprising the subsector declined.

Retail trade up as weather conditions improve

Retail trade posted a 0.6% gain after two consecutive monthly declines, as 7 of 12 subsectors increased. Leading the growth were building material and garden equipment and supplies (+4.6%), clothing and clothing accessories stores (+3.9%) and general merchandise stores (+2.4%), spurred by warmer weather conditions arriving across many parts of the country following a relatively cool start to spring. Growth was partly offset by lower activity among motor vehicle and parts dealers (-2.1%), who posted their third decline in four months.

Mining, quarrying and oil and gas extraction sector up

Mining, quarrying and oil and gas extraction increased 0.5%, as most subsectors expanded.

Oil and gas extraction (+1.4%) increased for the third time in four months. Oil and gas extraction (excluding oil sands) was up 2.3% in June, as the highest seasonally unadjusted crude oil production in Newfoundland and Labrador since August 2011—reflecting increased production capacity—more than compensated for a decline in natural gas extraction. Oil sands extraction increased 0.4%, with production ramping up at some facilities as the Government of Alberta continued easing oil production cuts instituted in January.

Mining and quarrying (excluding oil and gas) declined 2.4% in June, following three months of growth, as all industry groups were down. Non-metallic (-3.6%) and metal ore (-1.4%) mining declined as a result of lower demand from international markets for commodities such as potash and iron ore. Coal mining decreased 2.5%.

Support activities for mining and oil and gas extraction grew 1.8%, the third consecutive monthly increase, as all types of support activities were up.

Finance and insurance sector rises

The finance and insurance sector expanded 0.4% in June, the third increase in four months, as all subsectors grew. Credit intermediation and monetary authorities (+0.3%) and financial investment services, funds and other financial vehicles (+0.3%) were up, in part as a result of an increase in the issuance of new securities. Insurance carriers and related activities (+0.5%) were up for the fourth month in a row.

Manufacturing down, fully offsetting an increase in May

Manufacturing contracted 1.4% in June, continuing its sequence of increases alternating with declines seen since the end of 2018. The decrease was largely influenced by lower inventory formation, with durable (-0.7%) and non-durable (-2.1%) manufacturing both down.

Seven of nine subsectors contracted in non-durable manufacturing. Food manufacturing was down 2.6%, the largest decline since October 2012, with the most pronounced decline coming from meat products manufacturing (-7.0%). Plastic and rubber products (-5.0%) and chemical manufacturing (-2.3%) declined, with the majority of industries in those subsectors posting decreases.

Durable manufacturing fell, and was evenly split between increases and decreases among its 10 subsectors. Contributing the most to the decline were wood products (-4.8%) and fabricated metal (-2.4%), on account of lower international demand. Gains in miscellaneous manufacturing (+6.3%) and machinery (+0.3%) offset some of the decline. Transportation equipment edged up 0.1%, with increases in motor vehicle and motor vehicle parts manufacturing and decreases in most other industries.

Toronto Raptors’ playoff run and its influence on GDP

The Toronto Raptors’ journey to the National Basketball Association championship in June influenced the performance of diverse industries. The Raptors’ playoff run coincided with the first signs of summer-like weather across many parts of the country, with increases at food services and drinking places (+0.5%) and sporting goods, hobby, book and music stores (+3.5%). The performing arts, spectator sports and heritage institutions industry edged up 0.1% in June as most of the Raptors’ playoff games were held in May.

Other industries

Professional, scientific and technical services expanded 0.6% in June. Most industries were up, led by computer systems design and related services (+1.1%) and architectural, engineering and related services (+0.6%).

Activity at the offices of real estate agents and brokers grew 0.7% as housing resale activity in Ontario and Quebec increased.

Transportation and warehousing edged down 0.2%, as 10 subsectors saw a relatively even split between increases and decreases.

Utilities edged up 0.2%, driven by a broad-based increase in natural gas distribution.

Second quarter of 2019

Goods producing industries increased 1.1% in the second quarter, following declines in the three previous quarters. Services-producing industries were up 0.8%, the largest increase since the second quarter of 2017. Overall, gains were observed in 16 of 20 industrial sectors.

The mining, quarrying, and oil and gas extraction sector was up 5.8% in the second quarter, offsetting most of the declines in the previous three quarters. Oil and gas extraction saw the largest gain, up 6.8% from the previous quarter. This increase can be attributed in large part to the continued easing of the production curtailments imposed by the Government of Alberta in January 2019. Support activities for mining and oil and gas extraction were up 8.0%, following three consecutive quarterly declines. Mining and quarrying (excluding oil and gas) increased 2.4%, driven mainly by increased mining of copper, nickel, lead and zinc.

The construction sector edged up 0.2% after posting four consecutive quarterly declines. Residential construction (+0.8%) was up for the first time since the second quarter of 2018. Non-residential (+1.1%) and repair (+0.2%) construction also registered gains, while engineering and other construction (-0.9%) was down for the sixth quarter in a row.

The manufacturing sector edged down 0.1% in the second quarter. Non-durable manufacturing was down 0.3%, the third consecutive quarterly decline, with decreases in five of eight subsectors. Durable manufacturing was essentially unchanged, despite the contraction of 6 of 10 subsectors. Declines in machinery (-3.2%) and computer and electronic products (-2.8%) were offset by a strong quarter for fabricated metal products (+4.5%).

Among services-producing industries, the primary contributor to growth was real estate and rental and leasing services (+0.8%). Activity at real estate agents and brokers was up 4.1% due to increased housing resale activity across the country.

Wholesale trade increased 1.6%, the strongest quarter since the second quarter of 2017. Seven of nine subsectors were up, led by a 4.0% increase in machinery, equipment and supplies. The transportation and warehousing sector was up 1.3% as rail transportation activity recovered from a decline in the first quarter influenced by difficult weather conditions. Finance and insurance rose 0.7% due to increases in depository credit intermediation and insurance carriers. Retail trade edged up 0.1%, after having been essentially unchanged for two consecutive quarters.

The public sector grew 0.9% in the second quarter, with all three components (educational, health care and public administration) contributing to the increase.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/190830/dq190830b-eng.htm