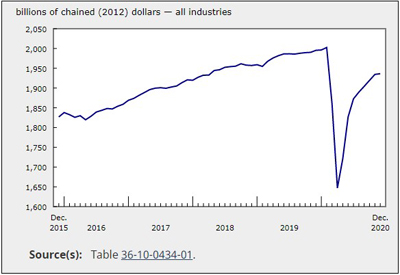

GDP Increased in December for 8th Consecutive Month

Mar 10, 2021

Real gross domestic product (GDP) edged up 0.1% in December, following a 0.8% increase in November. This eighth consecutive monthly increase continued to offset the steepest drops on record in Canadian economic activity in March and April. Nevertheless, total economic activity was about 3% below February’s pre-pandemic level.

Goods-producing industries were up 0.6% while services-producing industries edged down 0.1% as 12 of 20 industrial sectors increased in December.

Advanced information indicates an approximate 0.5% increase in real GDP for January 2021. The wholesale trade, manufacturing and construction sectors led the increase while retail trade declined. Owing to its preliminary nature, this estimate will be revised on March 31 with the release of the official GDP data for the January 2021 reference month.

Mining, quarrying, and oil and gas extraction sector keeps growing

The mining, quarrying, and oil and gas extraction sector grew 2.9% in December as all three subsectors expanded. With a fourth consecutive monthly gain, the sector continued recouping the declines largely experienced through the second and third quarters of the year, but remained about 7% below February’s pre-pandemic level of activity.

Oil and gas extraction rose 2.5% in December, up for the fourth consecutive month. Oil sands extraction grew 4.0%, driven by the highest level of synthetic oil production in Alberta since the series started in 1997, as a number of facilities continued ramping up production following production disruptions and delayed maintenance activities. Oil and gas extraction (except oil sands) was up 0.7%, the third gain in four months, as higher crude petroleum extraction more than offset lower natural gas extraction.

Mining and quarrying (except oil and gas) rose 3.6% in December, following a 7.4% jump in November. Non-metallic mineral mining increased 6.4% on the strength of potash mining (+13.2%), as international demand for the mineral strengthened in the last two months of the year. Metal ore mining expanded 2.1% as all types of activities were up. Growth in iron ore (+4.2%) and a surge in other metal ore mining (+13.2%) as uranium production resumed following pandemic-induced closures, contributed the most to the increase.

Support activities for mining, and oil and gas extraction grew 3.7%, the sixth consecutive monthly increase, as all types of support activities were up.

The public sector continues to grow

The public sector (educational services, health care and social assistance, and public administration) grew 0.6% in December, as all three components were up. Health care and social assistance rose 0.8%, led by ambulatory health care services (+1.7%). The educational services sector was up 0.6%, as elementary and secondary schools contributed the most to the increase. Public administration grew 0.5% as all levels of government services recorded growth in December.

Retail trade contracts

Sales in the retail trade sector fell 3.3% in December, after seven consecutive months of growth, as 10 of 12 subsectors were down. December saw the reintroduction of lockdown measures across many parts the country including the closure of all non-essential retailing and strict capacity and physical distancing control at essential retailers.

Activity at stores typically associated with the holiday shopping season declined as clothing and clothing accessories (-13.6%), general merchandise (-6.2%), sporting goods, hobby, book and music (-19.9%) and electronic and appliance (-10.3%) stores fell.

Activity at gasoline stations declined 3.4% in December as stay-at-home orders and other measures contributed to lower gasoline product demand during what would typically be a busy driving season.

Non-store retailers were also down (-1.1%) as many holiday-shoppers did their shopping early, anticipating restrictions and longer delivery times than usual. Only retailing activity at food and beverage stores (+0.3%) and health and personal care stores (+0.5%) was up as those were designated essential services and allowed to remain open under modified hours.

Wholesale trade contracts

Wholesale trade contracted 1.2% in December, the largest, and only the second, decline since April, as six of nine subsectors were down. Machinery, equipment and supplies wholesaling (-2.6%) contributed the most to the decline as the majority of industries were down, reflecting lower levels of exports and imports of machinery.

Motor vehicle and motor vehicle parts and accessories wholesaling was down 3.1%, as lower production and exports of passenger cars, light trucks and motor vehicle parts contributed to the decline. Miscellaneous (+1.0%), farm product wholesaling (+2.2%), and building material and supplies (+0.3%) offset some of the decline.

Manufacturing declines

The manufacturing sector contracted 1.1% in December, as lower sales and lower inventory contributed to the largest, and only the second decline in the sector since April.

Non-durable manufacturing decreased 1.6%, following three months of growth, as the majority of subsectors were down. Plastics and rubber products (-9.4%), petroleum and coal products (-4.4%) and chemical manufacturing (-1.6%) contributed the most to the decline while food (+2.1%) and paper manufacturing (+1.9%) partially offset some of the decreases.

Durable manufacturing contracted 0.6% as 4 of 10 subsectors decreased. Lower machinery (-3.6%), fabricated metal products (-2.7%) and primary metal manufacturing (-3.8%) contributed the most to the decline. Wood products (+2.8%), non-metallic mineral products (+3.3%), and computer and electronic products manufacturing (+3.2%) partly offset the declines.

Accommodation and food services decline

The reintroduction of lockdown measures in December across the country and announcements of additional travel restrictions to come took a bite out of accommodation and food services and contributed to a 6.8% contraction in the sector. Food services and drinking places were down 6.7%, as most types of restaurants and drinking places reported lower activity, while accommodation services shrank 7.1%.

Construction grows

Construction rose 1.2% in December, following a 0.3% contraction in November, as the majority of subsectors increased. Residential construction grew 1.4% in December as single-unit and alterations and improvements increased. Repair construction increased 1.5%, while engineering and other construction activities grew 1.4%. Non-residential construction was down for the sixth consecutive month, edging down 0.3% in December, with lower industrial and commercial construction offsetting an uptick in institutional construction.

Real estate and rental and leasing grows

Real estate and rental and leasing grew 0.9% in December, up for an eighth month in a row. With an 8.5% jump in December, activity at the offices of real estate agents and brokers more than offset the previous two monthly contractions to reach an all-time high as continued strong home resale activity across the country fueled the growth.

Other industries

Agriculture, forestry, fishing and hunting was up 1.1% in December led by higher crop production and forestry and logging.

Transportation and warehousing grew 0.7% as all subsectors, except for water transportation (-1.3%), were up in December.

The professional, scientific and technical sector was up 0.4%, the eighth consecutive increase, as the majority of industries grew in December.

The finance and insurance sector edged down 0.1% in December driven by a 2.0% decline in financial investment services, funds and other financial vehicles.

Utilities were essentially unchanged in December as an uptick in electric power generation, transmission and distribution (+0.3%) was offset by lower natural gas distribution (-1.8%).

Fourth quarter 2020

The COVID-19 pandemic has had unprecedented impacts across many industrial sectors. After a strong rebound in the third quarter, marked by the reopening of the economy following the first lockdowns, economic activity continued to expand in the fourth quarter. Value added of goods-producing industries grew 2.4% while services-producing industries rose 2.1%. Overall, there were gains in 18 of 20 industrial sectors.

The largest contributor to the increase in the services-producing industries was a 3.1% rise in the public sector (educational services, health care and social assistance, and public administration) as all three components rose. Health care and social assistance services grew (+3.5%), driven by ambulatory health care services (services provided by offices of physicians, health practitioners, dentists, medical and diagnostic laboratories). Educational services rose 3.8% while public administration was up 2.1% in the fourth quarter of 2020.

Professional, scientific and technical services (+3.6%) added to the growth as all industries within the sector were up in the quarter. Growth was led by computer systems design and related services (+3.2%), other professional, scientific and technical services including research and development (+5.0%) and legal services (+4.8%).

Finance and insurance rose 2.0%, on widespread growth across all subsectors. The momentum, seen in the third quarter in the securities markets, continued into fourth quarter. The high level of trading activity of federal government bonds, along with other increased activity such as the money market and the bond repo market, contributed to a 4.5% increase in financial investment services. Activity at depository credit intermediation and monetary authorities rose 1.3% as record-low interest rates on mortgages and loans encouraged lending to customers. Insurance carriers and related activities were up 2.8%.

Real estate and rental and leasing (+0.9%) increased for the second quarter in a row. Strong home resale market across the country pushed activity at the offices of real estate agents and brokers up (+3.1%) to record high levels.

The transportation and warehousing sector posted gains (+3.2%), with the majority of subsectors up, led by rail (+6.6%), truck (+1.6%) and air (+40.2%) transportation, as business activities continued to rebound for the second consecutive quarter.

Wholesale trade rose 1.7%, as eight of nine subsectors grew, led by a 4.2% increase in machinery, equipment and supplies wholesaling. Retail trade was up 0.7%, led by building material, garden equipment and supplies (+6.6%) supported by another strong increase in residential construction.

Mining, quarrying and oil and gas extraction rose 6.1%, the largest quarterly gain since the second quarter of 2019, as the sector continued offsetting the declines of the second and third quarters of 2020.

Oil and gas extraction expanded 5.2%, led by an 11.4% increase in the oil sands extraction as crude bitumen and synthetic oil production ramped up in Alberta. Oil and gas extraction (except oil sands) shrank 1.0% as growth in natural gas extraction was more than offset by lower crude petroleum, particularly at Canada’s North Atlantic facilities.

Support activities for mining and oil and gas extraction jumped by more than one-third (+35.0%), led by higher drilling and rigging services but remain well below levels from the beginning of the year.

Mining and quarrying (excluding oil and gas) rose 0.7% led by increases in coal (+14.1%) and iron ore (+9.7%) mining, coinciding with strong global demand for iron ore used in steel production. The gains were largely offset by a 13.9% decrease in potash mining, as international demand for the mineral declined.

Manufacturing gained 1.4%, following an 18.0% jump in the third quarter. Non-durable manufacturing rose 2.5% with gains largely concentrated in petroleum and coal product manufacturing (+11.5%) as activities at Canada’s refineries grew in the quarter. Durable manufacturing edged up 0.4% with gains in 7 of 10 subsectors. Leading the growth were fabricated metal (+4.1%), wood (+3.6%), and computer and electronic (+3.3%) product manufacturing. A 3.9% decline in transportation equipment manufacturing tempered the growth.

Construction grew 1.7%, up for the second consecutive quarter. Leading the growth was residential construction (+4.2%) as changing housing demand and declines in mortgage interest costs contributed to the increase. Repair (+4.7%) and engineering and other construction activities (+2.5%) were up, while non-residential construction declined 8.5% as all types of non-residential construction were down in the fourth quarter.

Year 2020

Activity was down in 17 of 20 industrial sectors in 2020 as the COVID-19 pandemic and measures put in place to reduce the spread of the virus affected economic activities to various degrees. Goods-producing industries’ value added declined 6.2%, the largest annual decrease since 2009. Services-producing industries contracted 4.9% over the year, the largest decline since the beginning of the series in 1961, and contributed more to the overall economic decline.

The decline in services-producing industries was widespread, affecting more adversely services whose online delivery is unfeasible or not economically viable. The transportation and warehousing sector dropped 19.8%, contributing the most to the decline in services. Air transportation (-73.7%) was severely impacted by the travel restrictions imposed by governments around the world. These measures led a large number of Canadian airlines to either completely shutter their operations or drastically reduce their operating capacity in 2020.

In concert with domestic and international travel restriction and also impacted by additional measures across many Canadian jurisdictions on indoor dining, the accommodation and food services sector fell by one-third (-33.4%). The public sector (education, health and public administration combined) decreased 4.3% driven mostly by health care and social assistance (-5.8%). Ambulatory health care services were down 13.3% in 2020 as offices of physicians, dentists and medical and diagnostic laboratories reduced many of their in-person visits and activities in response to the onset of the pandemic.

Finance and insurance (+3.8%) and real estate and rental and leasing (+1.7%) were the only two sectors in the services-producing industries to have positive growth in 2020 as government authorities responded decisively to help the economy. With regards to the global pandemic and to secure liquidity on the financial market, the Bank of Canada cut the overnight lending rate three times in 2020 and was engaged in large-scale asset purchase programs.

The main contributor to the decrease in goods-producing industries was manufacturing, which fell 9.5% in 2020 after edging down 0.2% in 2019. Durable manufacturing dropped 13.0%, mainly due to the transportation equipment subsector (-19.8%). This subsector was severely affected by the COVID-19 lockdown measures put in place in March and April 2020 as consumers decided to postpone the purchase of big-ticket consumer goods in the midst of uncertainty and lack of accessibility brought about by the pandemic. The contraction in non-durable manufacturing (-5.2%) was primarily the result of declines in petroleum and coal (-12.4%) and plastics and rubber (-10.2%) products. Across the manufacturing sector, the only subsector to increase its activities was miscellaneous manufacturing (+2.3%), which includes medical equipment and supplies manufacturing.

Mining, quarrying, and oil and gas extraction was down 9.7% in 2020 due to lower activity in the oil and gas extraction (-6.4%) and support activities for mining, and oil gas (-31.1%) extraction subsectors. Oil and gas (except oil sands) (-6.7%) and oil sands (-6.1%) extraction decreased, reflecting reduced global demand for energy products as a result of the COVID-19 pandemic. Mining and quarrying (except oil and gas) declined 7.6%.

The annual decline in construction (-3.7%) was mostly attributable to engineering and other construction activities (-8.6%). Non-residential construction fell 2.8% as remote work and online shopping reduced construction activity related to office buildings and shopping malls. Residential construction, in contrast, increased 1.1% in spite of the lockdown measures.

Consumers spent more on investment goods such as houses as social distancing measures and travel restrictions helped contribute to higher household savings.

The agriculture, forestry, fishing and hunting sector (+4.7%) was the sole goods-producing industries sector to post gains in 2020 as some of the subsectors were deemed essential and remained exempt from lockdown measures.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/210302/dq210302b-eng.htm