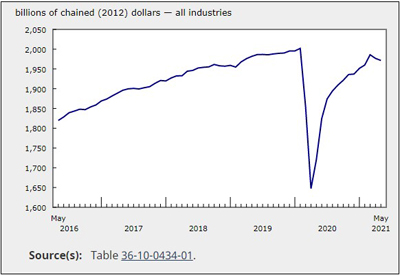

GDP Contracted 0.3% in May but Forecasted to Increase in June

July 30, 2021

Real gross domestic product (GDP) contracted 0.3% in May, following a 0.5% decline in April, and total economic activity was approximately 2% below February 2020’s pre-pandemic level.

Overall, 12 of 20 industrial sectors were down as both services-producing (-0.2%) and goods-producing industries (-0.4%) contracted.

Preliminary information indicates an approximate 0.7% increase in real GDP for June. Growth in retail trade and accommodation and food services were influenced by the easing of public health measures in many provinces in June. There were also gains in manufacturing and mining, quarrying, and oil and gas extraction, while construction and wholesale trade contracted. This advance estimate points to an approximate 0.6% increase in real GDP in the second quarter of 2021. Because of their preliminary nature, these estimates will be revised on August 31, with the release of the official GDP data for the June reference month and the second quarter of 2021.

Construction is down

Construction decreased 2.3% in May, after increasing in the previous five months.

Residential building construction contracted 4.2% in May, down for the first time since November 2020. Declines in single-family homes construction, and in alterations and improvements, more than offset increases in multi-unit dwellings construction.

Repair construction decreased 3.7%, while engineering and other construction activities was up 0.1% in May. Non-residential building construction edged up 0.1%, as growths in commercial and institutional building construction were offset by lower industrial building and structure construction.

Real estate and rental and leasing eases

The real estate and rental and leasing sector contracted 0.4% in May, following a 0.8% decline in April. This is the first back-to-back decline in the sector since March-April 2020. The output of offices of real estate agents and brokers fell 7.2% in May, following a 10.7% drop in April, returning to output levels similar to July 2020. Home resale activity slowed in almost all Canadian urban centres.

Retail trade continues to decline

Retail trade declined 2.7%, following a 5.7% drop in April, as 9 of 12 subsectors contracted in May. Store closures, in-store capacity reduction, limited hours of operation and other public measures put in place to combat the third wave of the COVID-19 pandemic in many parts of the country, continued to contribute towards lower retail activity.

Building material and garden equipment and supplies (-9.5%), motor vehicle and parts dealers (-3.5%), clothing and clothing accessories (-7.6%) and other traditional brick-and-mortar stores that rely more on in-store traffic, contributed the most to the declines.

Upticks at electronics and appliance stores (+1.3%) and food and beverage stores (+0.1%) mitigated some of the declines.

Manufacturing declines

The manufacturing sector contracted for the third time in four months, down 0.8% in May, as both durable and non-durable manufacturing declined.

Non-durable manufacturing was down 0.9% as declines concentrated in food (-2.5%), chemical (-3.2%) and petroleum and coal product (-2.0%) manufacturing more than offset increases in the remaining six subsectors.

Durable manufacturing decreased 0.8% in May, following a 1.9% decline in April, as six of ten subsectors were down. Contributing the most to the decline were fabricated metal product (-3.4%) and machinery (-2.6%) manufacturing; the latter subsector continued to be affected by a global microchip shortage. Non-metallic mineral product (-2.2%) and furniture and related product (-2.6%) manufacturing were also down, while transportation equipment (+1.0%), wood product (+1.2%), miscellaneous (+1.5%) and primary metal (+0.8%) manufacturing offset some of the declines.

Mining, quarrying and oil and gas extraction grows

Mining, quarrying, and oil and gas extraction grew for the third time in four months, up 2.0% in May, as all three subsectors increased.

The oil and gas subsector increased for the third consecutive month, rising 2.6% in May, as all forms of activity were up in the month. Oil sands extraction rose 3.2% in May, as a number of facilities and sites ramped up production after some worksites in the Regional Municipality of Wood Buffalo in Alberta experienced COVID-19 outbreaks and lowered or suspended production in April. Oil and gas extraction (except oil sands) grew 1.8%, as both crude petroleum extraction and natural gas extraction were up.

Support activities for mining, and oil and gas extraction grew 3.2% in May, as all types of services were up.

Mining and quarrying (except oil and gas) rose 0.3% in May, growing for the sixth time in the last seven months. Metal ore mineral mining grew 0.9% as gold and silver mining increased and uranium mining activities restarted following pandemic-related closures at a number of sites. Coal mining increased 0.4% in May, while non-metallic mineral mining decreased 1.1%, primarily as a result of a decline in potash mining.

The public sector increases

The public sector (educational services, health care and social assistance, and public administration) advanced 0.7% in May, more than offsetting a 0.5% contraction in April.

Educational services were up 2.0% in May. Elementary and secondary schools led the growth (+3.8%) as activity returned to normal levels following the Government of Ontario’s decision to move the annual spring break from mid-March to mid-April.

Health care and social assistance rose 0.6%, as most industries advanced.

Public administration was essentially unchanged (0.0%) as decreases in municipal, provincial and territorial, and aboriginal public administration, were offset by a 0.8% increase in federal government public administration, as 2021 Census of Population and 2021 Census of Agriculture activities were underway.

Other industries

Finance and insurance increased 0.4% in May, up for the fourth time in the last five months. Financial investment services, funds and other financial vehicles rose 1.6%, and insurance carriers and related activities grew 0.7% following three monthly declines.

Transportation and warehousing declined 1.4% in May. Lower rail (-5.4%), support activities (-1.7%), truck (-1.1%) and pipeline transportation (-1.5%) contributed the most to the decline.

Professional, scientific and technical services rose 0.4% in May as the majority of services were up. Leading the increase were computer systems design and related services (+1.2%) and architectural, engineering and related services (+0.5%). Legal services (-0.9%), which derive much of their activity from real estate transactions, offset some of the gains.

Accommodation and food services declined 2.4% in May, following a 4.3% decrease in April. Both accommodation services (-5.3%) and food services and drinking places (-1.3%) were down, affected by public health measures aimed at slowing the third wave of the COVID-19 pandemic.

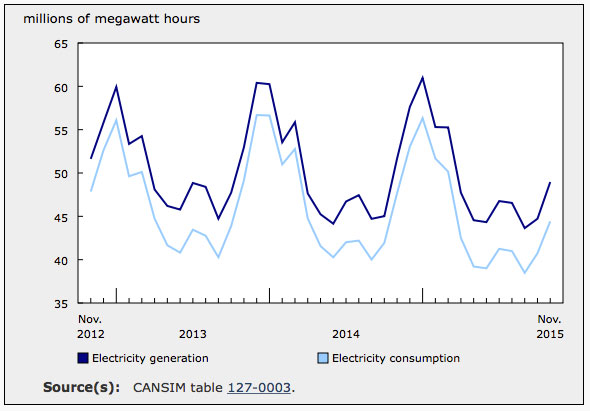

Utilities were up 0.9%, as all subsectors grew in May, led by electric power generation, transmission and distribution, as well as natural gas distribution, both up 0.9%.

Wholesale declined 0.6% in May, partly offsetting growth in the previous two months. Increases in machinery, equipment and supplies (+1.3%) and food, beverage and tobacco (+2.4%) were more than offset by lower building material and supplies (-4.5%), personal and households goods wholesaling (-1.8%).

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/210730/dq210730a-eng.htm