Early Spring COVID Restrictions Took a Toll on Closings and Openings

July 26, 2021

In late March and early April 2021, a sustained increase in COVID-19 cases — considered to be the third wave of the pandemic — was noted in several provinces.

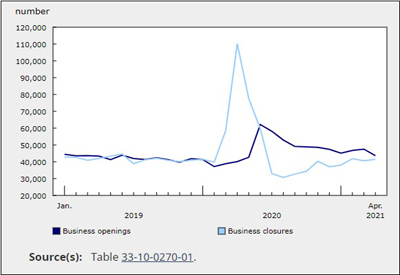

As public health restrictions were tightened in many jurisdictions, the number of business closures increased by 1.9% in April. This was the smallest percentage increase in monthly closures since January 2020 despite the lockdown in many provinces, suggesting that recent restrictions had little impact on closures. The number of business openings fell 8.2% in April after two consecutive months of positive growth. However, the April level is comparable to pre-pandemic levels (41,600 on average). The number of active businesses grew 0.9% in April, as openings remained above closures.

Despite the decline in business openings, the number of entrants grew 3.7% in April, the fourth consecutive month with positive growth. Since December 2020, the share of entrants in all openings has been increasing to total at 41.5% in April. Re-openings accounted for the remaining 58.5% of openings.

In April 2021, the number of business closures increased in all provinces and territories following the widespread decline in March. Quebec (+0.8%;+57) showed the lowest growth in closures, followed by Alberta (+0.9%; +51), while Nova Scotia (+12.8%; +97) and Prince Edward Island (+8.9%; +18) posted the highest percentage change across provinces. In terms of business openings, in April 2021, Quebec was the only province or territory to post more openings than the previous month (+2.6%; +219). The Atlantic provinces, Ontario and Saskatchewan showed their first decline in openings since January.

The scope of public health measures in April was different across provinces, and the number of active businesses varied accordingly. In April 2021, the number of active businesses decreased for the first time in Ontario since May 2020 (-0.3%; -1,004) compared with the previous month (Chart 2), which may have been driven by a stay-at-home order introduced in early April, allowing only essential businesses to remain open. In contrast, British Columbia (+0.4%; +572) had the highest growth of active businesses among all provinces in percentage terms, followed by Prince Edward Island (+13), Nova Scotia (+56) and Manitoba (+86), with 0.3%.

With the exception of Prince Edward Island (+1.8%), British Columbia (+2.2%) and the territories, all provinces remained below their pre-pandemic level of active businesses (Chart 2).

In the tourism sector, business closures outnumbered openings for the first time since May 2020

The tourism sector continued to see an increase in the number of business closures in April 2021 (+4.2%; +147). Furthermore, openings dropped by 13.8% (-541) from March. For the first time since May 2020, the number of openings in the tourism sector was lower than the number of closures, resulting in a decrease of 0.2% (-140) in the number of active businesses. The latter remained 7.4% below its pre-pandemic level.

In April, most industries showed an increase in the number of business closures. Among the industries most affected by the pandemic, retail trade (+5.8%; +161) and accommodation and food services (+8.7%; 232) posted more business closures compared with March 2021. In contrast, the number of business closures in arts, entertainment and recreation (-14.5%; -116) fell for the second consecutive month (-12.9% in March); as a result, the number of closures was slightly lower than the 2015-to-2019 historical average. As some non-essential businesses in certain regions, such as recreation and fitness facilities in Toronto, remained closed for a number of months, this could suggest that businesses at greatest risk of closing had potentially already closed.

The decrease in business openings was widespread across all industries in April 2021. The number of business openings in arts, entertainment and recreation (-9.7%; -103) and accommodation and food services (-27.4%; -838) fell for the first time this year.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/210726/dq210726d-eng.htm?CMP=mstatcan