COVID-19 Economic Impact on Wholesale Trade in Canada, May 2020

July 31, 2020

Total May 2020 sales: $52.6 billion

Monthly change: +5.7%

Following historic declines in April that saw wholesale sales plummet an unprecedented 21.4% due to the COVID-19 pandemic, wholesale sales increased 5.7% to $52.6 billion in May. Six of seven subsectors recorded higher sales, accounting for about 78% of total wholesale sales. In dollar terms, the building material and supplies and the motor vehicle and motor vehicle parts and accessories subsectors contributed the most to the gain.

Wholesale sales volumes increased 5.2%.

COVID-19 recovery and impacts

After rising 1.7% in January to $65.1 billion, sales in the wholesale trade sector fell sharply as a result of the COVID-19 pandemic and the railway shutdowns that preceded it. From February through April, sales of wholesale goods fell $15.3 billion. The increase of $2.8 billion in May amounts to a recovery of 18.4% of the 2020 decline. Wholesale sales in May remained $12.5 billion (-19.2%) below January’s level.

About 60% of the difference in sales between January and May came from the motor vehicles and motor vehicle parts subsector. Sales in this subsector rose in February, despite the rail blockades, but fell $8.6 billion in March and April combined. While sales in the subsector rose $1.0 billion in May, they were still $7.5 billion below the recent high in February, and $7.2 billion (-63.2%) below January 2020. The sales pattern here largely reflects manufacturers being closed for all of April and parts of May—there was little inventory for most motor vehicle and motor vehicle parts wholesalers to sell as Canadian motor vehicle manufacturing sales fell 97.8% in April and only partially recovered in May. However, this pattern was not uniform across the wholesale motor vehicle subsector. Some motor vehicle and motor vehicle parts wholesalers were able to access inventory that was available or in transit to make sales in April. For these companies, the low point in sales came in May, not April, despite the fact that the economy started to re-open in May.

By comparison, the food and beverage subsector has not experienced the same size of shocks as other subsectors. Food, beverage and tobacco sales in May were only 2.1% lower than January sales. There are a number of factors for this. Food is traditionally less prone to economic shocks as the demand for food is largely stable. Indeed, grocery stores have largely been open throughout the pandemic. March was actually a strong month for food, beverage and tobacco wholesalers despite the onset of the pandemic, with sales rising 8.6%. This may be due in part to stockpiling by consumers at the beginning of the pandemic. After an 11.4% drop in April, sales in May rose 3.4% to $12.1 billion. Sales in May were $258.0 million below January’s level, and $1.1 billion lower than the subsector’s most recent high in March. Wholesale food and beverage sales throughout this period reflect similar activity in the retail sector, where sales from food and beverage stores rose 23.5% in March and only partially pulled back in April. In contrast, sales by food services and drinking places fell 58.6% from February to April.

May sales for the remaining subsectors were $5.0 billion (-12.2%) below January levels.

Notwithstanding the increases in sales in May, COVID-19 was still having a large negative effect on wholesalers, with 73% of them reporting that the pandemic had an impact on their businesses—only 7 percentage points lower than the month before. Moreover, no subsectors appeared to be shedding COVID-19 impacts in May, as the percentage of wholesalers reporting an impact from COVID-19 ranged from a low of 64% in the food, beverage and tobacco subsector to a high of 86% in the personal and household goods subsector.

Wholesalers estimated that COVID-19 caused a $16.5 billion drop in sales, with more than half of that coming from the motor vehicle and motor vehicle parts subsector.

Sales rise in six of seven subsectors

With the Canadian construction industry fully resuming in May, the building material and supplies wholesale subsector saw the largest gain in dollar terms in May, up 16.1% to $7.8 billion. While all three industries within the subsector saw their sales rise, the gains were largely attributable to higher sales in the lumber, millwork, hardware and other building supplies industry, where sales increased 20.4% to $4.2 billion.

Following a drop of 65.7% in April, the motor vehicle and motor vehicle parts and accessories subsector rebounded 33.4% to $4.2 billion in May. With most auto manufacturers resuming production in May, the wholesale sector saw growth in both the motor vehicle (+33.0%) and the new motor vehicle parts and accessories (+33.6%) industries.

Only machinery equipment and supply wholesalers reported lower sales in May, down 4.7% to $11.5 billion.

Sales higher in Ontario and Quebec

Seven provinces recorded higher sales in May, with Ontario and Quebec posting the largest increases.

Ontario sales rose 8.5% to $25.0 billion, following a 29.9% decline in April. Higher sales were recorded in six of seven subsectors, with the machinery, equipment and supplies subsector (-5.4% to $5.9 billion) posting the lone decline. The motor vehicle and motor vehicle parts and accessories subsector led the gain, recording a $1.1 billion increase from April, up 121.3% to $2.0 billion. The reopening of motor vehicle manufacturing plants and retail dealerships generated the higher sales.

Sales in Quebec rose 8.9% to $10.7 billion in May, following an 18.0% decline in April. Four of seven subsectors recorded higher sales, led by the building material and supplies subsector and the personal and household goods subsector. The building material and supplies subsector rose 39.6% to $1.7 billion in May, more than offsetting a 27.4% decline in April. Higher sales were recorded in each of the subsector’s industries, led by the lumber, millwork, hardware and other building supplies industry. Sales in the personal and household goods subsector climbed 14.7% to $2.4 billion, following three consecutive monthly declines.

Alberta recorded the largest dollar-value decline in May, down 5.1% to $5.9 billion. Lower sales were recorded in four of seven subsectors, with the machinery, equipment and supplies subsector leading the decline (down 12.4% to $1.7 billion). Respondents stated that the reduction in sales was mainly attributable to closures of customer plants and non-essential business shutdowns.

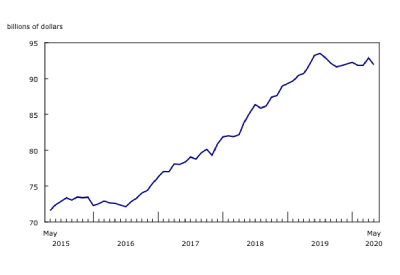

Inventories drawn down in May

Wholesale inventories declined 1.0% to $91.9 billion in May. Five of seven subsectors recorded decreases, accounting for about 73% of total wholesale inventories. The last time inventories fell more than 1.0% was in November 2017.

In dollar terms, the machinery, equipment and supplies subsector led the declines in May, down 3.2% to $26.5 billion as decreases were seen in all four industries. Roughly two-thirds of the subsector’s decline was attributable to the construction, forestry, mining, and industrial machinery, equipment and supplies industry, down 4.5% to $12.4 billion in May.

After rising to a record 1.87 in April, the inventory-to-sales ratio dropped to 1.75 in May. Five of seven subsectors recorded decreases in their inventory-to-sales ratios, with the motor vehicle and motor vehicle parts and accessories subsector contributing the most.