Canadian Survey on Business Conditions, Third Quarter 2022

August 30, 2022

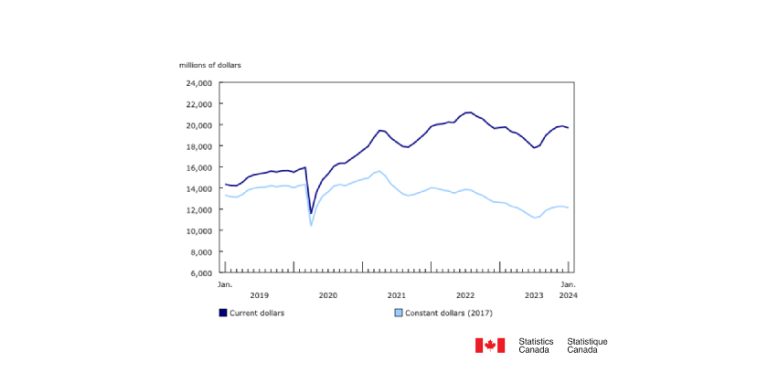

Real gross domestic product (GDP) was essentially unchanged in May, following a moderate 0.3% expansion in April. Inflationary pressures continued in July, when the Canadian Consumer Price Index (CPI) rose 7.6% year over year, following an 8.1% gain in June. Employment fell by 43,000 (-0.2%) in June, marking the first employment decline not associated with a tightening of public health restrictions since the beginning of the COVID-19 pandemic. There was a further decrease in July (-31,000), while the unemployment rate remained at a record low of 4.9%.

In this macroeconomic context, Statistics Canada conducted the Canadian Survey on Business Conditions from July to early August 2022. The survey collects information on the environment that businesses are currently operating in and on their expectations for the future.

The combination of inflationary pressures, labour challenges, and supply chain issues has impacted businesses in a number of different ways. Over the next three months (see Note to readers) businesses continue to expect to face a variety of obstacles related to rising costs, hiring and retention, as well as those related to supply chains and rising inflation. Almost one-third of businesses that are facing challenges maintaining inventory levels or acquiring inputs, products and supplies, either domestically or abroad, expect these challenges to worsen in the short term. Over the next three months, half of businesses expect their profitability to remain relatively unchanged, one-third expect to increase the prices they charge, and four-fifths expect their number of employees to remain the same.

Businesses expect to face obstacles related to rising inflation and costs

Many businesses expect to continue facing challenges due to rising inflation and costs related to inputs, transportation and insurance. Prices of raw materials purchased by manufacturers operating in Canada, as measured by the Raw Materials Price Index, increased by 19.1% year over year in July, following a 32.4% year-over-year increase in June, while energy prices increased 38.8% year over year in July. Meanwhile, average hourly wages for employees rose 5.2% on a year-over-year basis in July.

Rising inflation was the top obstacle business expected over the next three months, with three in five businesses (60.0%) expecting it to be an obstacle, led by businesses in accommodation and food services (78.2%), construction (72.0%) and manufacturing (67.8%).

The rising cost of inputs, including labour, capital, energy, and raw materials, was the second most expected obstacle, with 47.1% of businesses expecting it to be an obstacle, down slightly from nearly half (49.7%) of businesses in the second quarter. The rising cost of inputs was expected to be an obstacle for around 7 in 10 businesses in agriculture, forestry, fishing and hunting (71.7%), manufacturing (71.3%), and accommodation and food services (69.6%).

Nearly two-fifths (38.4%) of businesses expected transportation costs to be an obstacle over the next three months, led by businesses in transportation and warehousing (63.8%) and businesses in construction (61.9%).

Overall, 31.7% of businesses expected the cost of insurance to be an obstacle over the next three months. This is the case for more than half (51.0%) of businesses in transportation and warehousing and over two-fifths (43.3%) of businesses in construction.

Supply chain challenges continue

Over one-quarter (26.8%) of businesses expect difficulty acquiring inputs, products or supplies domestically over the next three months. Of these businesses, over half (54.3%) expect these challenges to continue for six months or more, down slightly from the previous quarter (57.3%). Meanwhile, one-third (33.3%) are uncertain how long these challenges will persist. Nearly half of businesses in construction (47.8%) and over two-fifths of businesses in manufacturing (43.9%) expect difficulty acquiring inputs, products or supplies domestically over the next three months.

Of businesses that expect supply chain challenges over the next three months, whether that be difficulty maintaining inventory levels, or acquiring inputs, products or supplies domestically or abroad, nearly three-fifths (58.2%) reported that the challenges the business experienced have worsened over the last three months, down from over two-thirds (67.9%) of businesses in the second quarter. Leading factors that contributed to worsened supply chain challenges businesses experienced were increased delays in deliveries of inputs, products or supplies (82.7%); increased prices of inputs, products or supplies (78.3%); and supply shortages resulting in fewer inputs, products or supplies being available (72.3%).

While almost 1 in 10 (9.5%) businesses expect supply chain challenges to improve over the next three months, almost three-fifths (58.6%) of businesses expect the situation to remain about the same, and nearly one-third (31.9%) expect supply chain challenges to worsen.

Fewer businesses expect to raise prices over the next three months compared with the previous quarter

The CPI rose 3.4% on an annual average basis in 2021, following an increase of 0.7% in 2020. However, in July 2022, Canadian consumer prices rose 7.6% year over year, following an 8.1% increase in June. This increase in June was the largest yearly change since January 1983. When asked about their expectations over the next three months, over one-third (34.0%) of businesses expect to raise prices. Although this was down from nearly two-fifths (39.0%) in the second quarter of 2022, the decrease follows three quarters of continued increases in the proportion of businesses anticipating raising prices. Over half of businesses in retail trade (54.1%) and wholesale trade (51.0%), and half (50.0%) of businesses in accommodation and food services expect to raise prices over the next three months.

Half (50.0%) of businesses expect profitability to remain relatively unchanged over the next three months. Over one-third (35.9%) expect their profitability to decrease, while 11.2% expect their profitability to increase. Expectations on future profitability differ by industry. Nearly three-fifths (58.7%) of businesses in accommodation and food services, over half (51.4%) of businesses in transportation and warehousing, and over two-fifths (42.7%) of businesses in agriculture, forestry, fishing and hunting expect profitability to decrease. Meanwhile, 16.9% of businesses in manufacturing and 16.8% of businesses in retail trade expect profitability to increase.

Four-fifths (80.4%) of businesses expect to retain the same number of employees over the next three months, up from 76.9% during the second quarter. In contrast, 7.2% of businesses expect their number of employees to decrease, up from 5.0% in the second quarter. In accommodation and food services, 14.0% of businesses expect a decrease in their number of employees over the next three months.

Businesses have recruitment, retention and training plans to address workforce-related obstacles

Businesses have been facing obstacles related to the workforce. Amid elevated labour demand, recent labour market tightness has been characterized by low unemployment rates, and high labour force participation among those in the core working ages of 25 to 54. The unemployment rate of the population in the core working ages was 4.0%, while the labour force participation rate was 87.9% in July 2022.

Recruiting skilled employees was expected to be an obstacle over the next three months for nearly two-fifths (38.7%) of all businesses, led by those in construction (51.1%), health care and social assistance (49.3%) and accommodation and food services (48.9%). In addition, shortage of labour force was expected to be an obstacle for close to two-fifths (37.1%) of businesses, while retaining skilled employees was expected to be an obstacle for nearly one-third (30.9%).

Of businesses that expect to have labour-related obstacles (shortage of labour force, recruiting skilled employees or retaining skilled employees) over the next three months, over three-fifths (61.8%) reported that challenges related to recruiting and retaining staff are more challenging than 12 months ago.

In terms of vacant positions, 8.2% of businesses expect to have more job vacancies over the next three months, relatively unchanged from 8.8% of businesses in the second quarter. However, 21.7% of businesses in accommodation and food services expect to have more vacant positions, over double the proportion of all businesses, in the third quarter.

Majority of businesses anticipate positive average yearly growth over the next three years

Nearly three-quarters (72.9%) of businesses expect positive average yearly growth over the next three years, with nearly two-thirds (65.0%) anticipating growth ranging from 1% to 15% per year. Meanwhile, 14.6% of businesses anticipate no growth over the next three years. Of these businesses, over one-third (34.3%) are satisfied with their current level of revenue, while 27.7% do not believe the economic environment can support significant growth.

Interprovincial trade and obstacles

Just over one-fifth (21.4%) of businesses either exported goods or services to or imported goods or services from another province or territory over the last 12 months. Over half of these businesses conducted interprovincial trade activities with Ontario (57.0%), while nearly half did with British Columbia (48.1%), Alberta (46.6%) and Quebec (41.9%). Meanwhile, 5.7% of businesses did not trade interprovincially due to obstacles in conducting business in another province or territory. Of the businesses that traded interprovincially or reported that obstacles prevented them from doing so, 16.5% cited labour shortages and 15.5% cited geography or distance as being obstacles.

Future outlook

Over two-thirds (69.4%) of businesses reported being either very optimistic or somewhat optimistic about their future outlook over the next 12 months. The businesses most likely to be optimistic about their future outlook were those in arts, entertainment and recreation (80.9%) and health care and social assistance (80.0%).