Building Permits, September 2024

November 15, 2024

The total value of building permits in Canada increased by $1.3 billion (+11.5%) to $13.0 billion in September, reaching the second-highest level since the start of the new series in January 2017. Ontario’s construction intentions grew by $1.2 billion (+25.0%) to $5.9 billion in September 2024, leading gains in both the non-residential and residential sectors.

On a constant dollar basis (2017=100), the total value of building permits rose 11.6% in September.

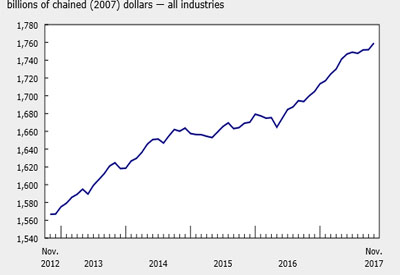

Chart 1

Total value of building permits, seasonally adjusted

Infographic 1

Building permits, September 2024

Ontario’s institutional construction intentions push up the non-residential sector

The total value of non-residential building permits increased by $797.5 million (+18.0%) to $5.2 billion in September, driven by gains in the institutional component (+$824.9 million). However, industrial (-$17.6 million) and commercial (-$9.9 million) construction intentions edged down.

Ontario’s institutional component (+$502.1 million) reached $801.2 million in September, a second series-high level, which drove national gains. Ontario’s institutional component received significant contributions from construction intentions for long-term care facilities across the province and a hospital permit in Prince Edward County. The Ontario government announced in the 2024 Budget to continue efforts to increase the province’s long-term care capacity. The total institutional component was also supported by gains in Manitoba (+$99.5 million) and Alberta (+$90.0 million) in September.

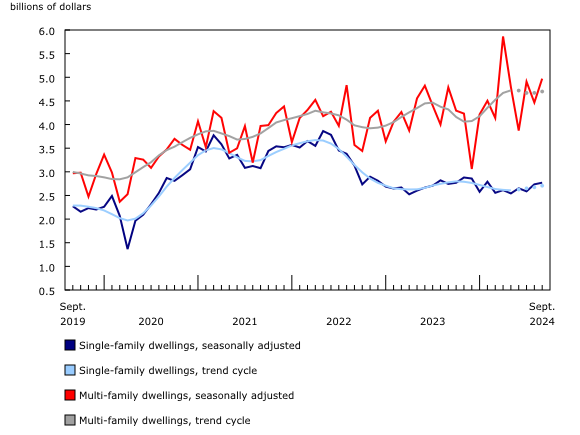

Chart 2

Value of building permits for the single-family and multi-family components

Chart 3

Value of building permits for the residential and non-residential sectors

Growth in Ontario’s multi-unit component fuels the residential sector

Construction intentions for the residential sector rose by $540.7 million (+7.5%) to $7.7 billion in September, led by the multi-unit component (+$505.5 million), while the single-family component (+$35.1 million) contributed modestly. Multi-unit construction intentions were driven by Ontario (+$812.3 million), specifically by large multi-unit permits in Toronto, Barrie and Mississauga.

Ontario’s industrial construction intentions drive the non-residential sector to a quarterly series high

The total value of building permits in the third quarter was $37.0 billion, up by $2.0 billion (+5.6%) from the previous quarter ($35.1 billion). This marked the third consecutive quarterly increase and the highest quarterly value recorded in the series.

Construction intentions in the non-residential sector grew by $1.9 billion (+14.6%) to an all-time high of $14.6 billion in the third quarter, outpacing the previous record of $13.6 billion reached in the first quarter of 2023. In the third quarter of 2024, the quarterly growth was largely attributed to Ontario’s non-residential sector (+$1.5 billion), which reported significant gains in the industrial component (+$1.0 billion). As a result, the total value of industrial building permits reached a national record high of $4.0 billion (+$1.4 billion) in the third quarter, supported by major permits issued in August for a battery plant in St. Thomas, Ontario.

The overall growth in the non-residential sector in the third quarter was also supported by increases in the institutional component (+$590.1 million), but it was tempered by a slight decline in the commercial component (-$89.9 million).

Construction intentions in the residential sector edged up 0.5% (+$101.1 million) to $22.4 billion in the third quarter, representing the slowest growth out of the first three quarters of 2024. The increase in the third quarter was due to the rise in the single-family home component (+$285.9 million), following two consecutive quarterly declines.

Meanwhile, declines in the multi-unit component (-$184.8 million), the first quarterly decline since the start of 2024, moderated the gains in the residential sector. Despite this decrease in the multi-unit component, it recorded the second highest quarterly level ($14.3 billion) in the third quarter, following the record high of the previous quarter ($14.5 billion). This high level was supported by broad-based growth in the number of permits issued in Quebec and substantial values of permits issued in Ontario.