Building Permits, January 2025

March 17, 2025

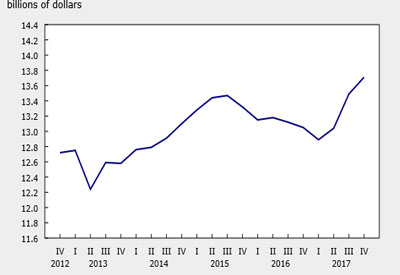

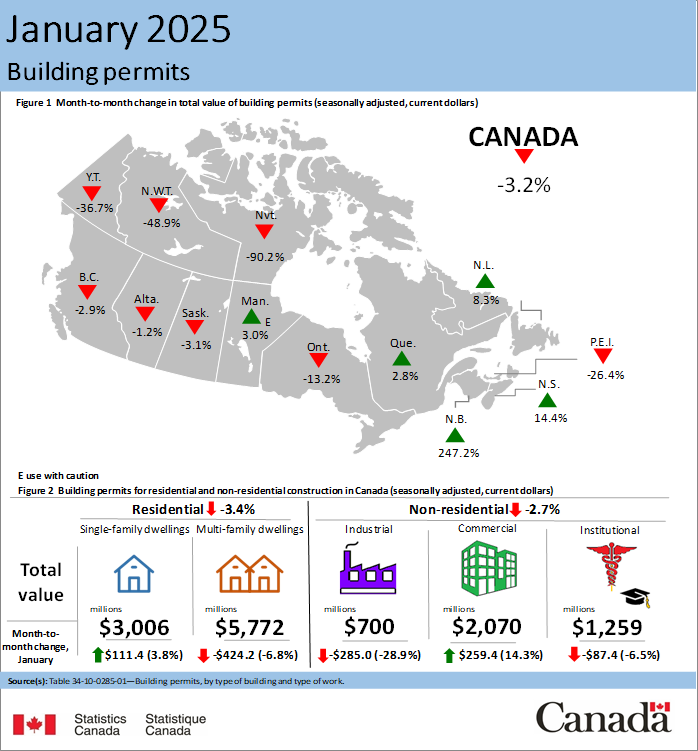

In January, the total value of building permits issued in Canada decreased by $425.8 million (-3.2%) from the previous month to $12.8 billion. Ontario (-$771.1 million) led the decline, while New Brunswick (+$356.8 million) tempered it the most.

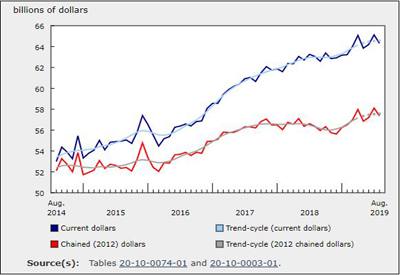

On a constant dollar basis (2017=100), the total value of building permits issued in January declined 2.5% from the previous month, while it was up 13.4% on a year-over-year basis.

Chart 1

Total value of building permits, seasonally adjusted

Infographic 1

Building permits, January 2025

Ontario’s multi-family component leads residential sector decline

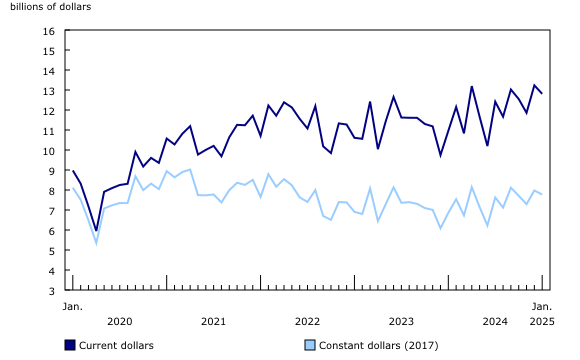

Residential construction intentions decreased by $312.7 million (-3.4%) to $8.8 billion in January after increasing by $1.7 billion in December 2024. Overall, the multi-family component declined by $424.2 million in January 2025, while the single-family component increased by $111.4 million.

Ontario’s multi-family component (-$738.5 million) led the decline in January, after being a significant contributor to residential sector gains in the previous month.

New Brunswick (+$195.9 million) and Quebec (+$186.3 million) partially offset residential sector losses in January. The monthly gains in New Brunswick’s residential sector were due to the multi-family component (+$199.7 million) and were concentrated in the Fredericton census metropolitan area (CMA) (+$83.9 million) and in the Moncton CMA (+$78.5 million). Quebec’s residential sector growth was also driven by the multi-family component (+$139.8 million), fuelled by gains in the Montréal CMA (+$160.2 million), and supported by the province’s single-family component (+$46.5 million).

Across Canada, 23,500 multi-family dwellings and 4,900 single-family dwellings were authorized in January, down 3.7% from the previous month, but up 37.4% on a year-over-year basis.

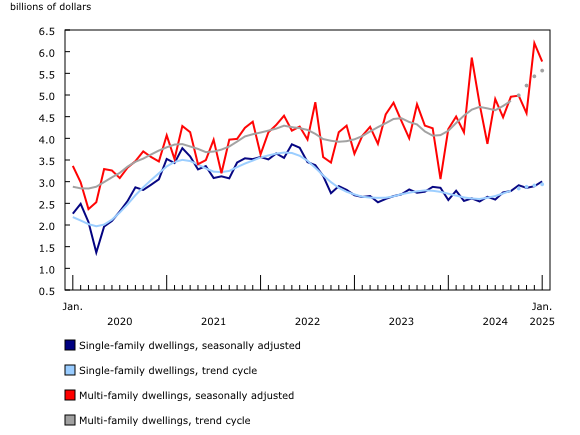

Chart 2

Value of building permits for the single-family and multi-family components

Chart 3

Value of building permits for the residential and non-residential sectors

Industrial construction intentions push down the non-residential sector

The value of non-residential building permits decreased by $113.0 million (-2.7%) to $4.0 billion in January, a fourth consecutive monthly decrease. The industrial component (-$285.0 million) drove the decline, followed by the institutional component (-$87.4 million). The commercial component (+$259.4 million) mitigated the decline in the non-residential sector.

January declines in the industrial component were led by Ontario (-$204.7 million) and Alberta (-$74.6 million).

The decrease in the institutional component in January was driven by British Columbia (-$136.7 million) and Alberta (-$74.9 million), while New Brunswick (+$70.9 million) and Nova Scotia (+$62.0 million) mitigated the decline.

Gains in commercial construction intentions in January were led by Alberta (+$153.3 million) and New Brunswick (+$95.4 million).