Are Your Sales and Marketing Teams Inhibiting Growth?

Aug 13, 2018

By David Gordon

We’re at mid year and we’re hearing a wide array of distributor and manufacturer performance. Industry forecasters state the market should be around 6%, which begs this question: are you above the industry forecast and growing or are you letting rising seas to lift all? In essence, are you generating growth, content with market performance, or lagging the market?

And if you are floating with the market, consider:

- the impact of increases in steel and aluminum. Are your unit sales higher than last years or are your sales artificially inflated?

- What about lighting? With continued price erosion, are you selling more units? Closing more projects? Improving your close rate?

- What about operational costs? Are they growing less than your sales and gross margin growth rate, thereby enabling you to improve your net profit? If not, are you treading water?

Why think about this?

Could your sales and marketing team inhibit your growth?

Yes, it’s a strange question because, aren’t these the departments and people that are supposed to generate, ideally lead us to growth?

According to a study conducted by Jim Dickie of CSO Insights, sales and marketing challenges can lead to sub-optimal performance. For some companies this can explain declining or static performance (defined as flat or only market level performance.) If you want to outperform the market, your sales and marketing teams need to outperform the competition.

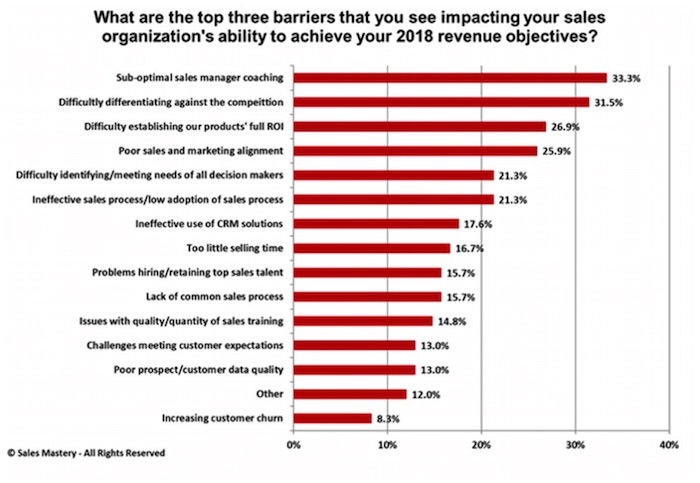

Sales Mastery/CSO conducted a survey of sales and marketing executives at the end of 2017. Respondents shared what they see as barriers within their companies:

The question becomes, are you willing to positively critique your company? We’re not saying every salesperson needs to be, or will become, an “A” player in sales or that your marketing department can do everything, flawlessly and the most cost-effectively while anticipating sales, customer and supplier needs. What we are saying is that everyone can be reviewed, opportunities identified, and performance-impacting trends (or barriers) noted so that improvement can be made. The first step to a different tomorrow is a change today.

Or consider it from a third perspective.

If you segment your customer base, your salespeople and your activities into segments of one third each, how can you get one third inside that one third to incrementally do better? But what do they need to do it?

In the above chart, the #1 issue is sales manager coaching. How can this process be improved within your organization, if there is a process? How can it be standardized based on reviewing how top performers do?

Consider this exercise

- Ask your salespeople what inhibits their performance

- Ask marketing what inhibits its performance

- Survey the audience about the degree of impact on each issue

- Identify top sales performers and your agreed upon marketing successes to identify trends

- Promote, and train, to the new processes and expectation

And the hardest part is honesty. When you look at the top four answers in the chart — sales management, value proposition, training on communicating ROI (i.e., selling vs. relationship and order acceptance), and agreement on strategy/collaboration — the question becomes, for the second half of 2018, do you need a quick reset? Or is this a systemic issue that needs to be addressed as part of your 2019 planning process with a continuous improvement process developed to strengthen the organization?

Not all things can change, but if you leave it to the individuals can you affect change?

David Gordon is President of Channel Marketing Group. Channel Marketing Group develops market share and growth strategies for manufacturers and distributors and develops market research. CMG’s specialty is the electrical industry. He also authors an electrical industry blog, www.electricaltrends.com. He can be reached at 919-488-8635 or dgordon@channelmkt.com.