Industrial Product and Raw Materials Price Indexes, August 2023

September 18, 2023

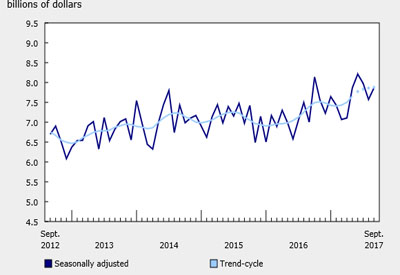

Prices of products manufactured in Canada, as measured by the Industrial Product Price Index (IPPI), rose 1.3% month over month in August and fell 0.5% year over year. Prices of raw materials purchased by manufacturers operating in Canada, as measured by the Raw Materials Price Index (RMPI), increased 3.0% on a monthly basis in August and posted a 4.3% year-over-year decline.

Industrial Product Price Index

The IPPI rose 1.3% month over month in August. This was the first monthly increase in the IPPI since October 2022 (+2.3%). Year over year, the IPPI was down 0.5% in August 2023.

Higher prices for refined petroleum energy products (+10.6%) led the monthly increase in IPPI. Increases were widespread within this category in August, including gains for diesel (+16.8%) and finished motor gasoline (+4.2%). These increases coincided with a month-over-month increase in the average price of crude oil—the main input used to produce refined petroleum. West Texas Intermediate crude oil, a main oil reference price used in North America, started July at around $70 USD per barrel and closed August at around $83 USD per barrel.

This upward trend in crude was influenced by the expectation of the Organization of the Petroleum Exporting Countries and its partners (OPEC+) continuing its voluntary production restriction on crude production by its members. Compared with August 2022, prices for refined petroleum energy products fell 8.4%.

Prices for chemicals and chemical products increased 3.5% month over month in August 2023, following seven months of consecutive declines. The monthly gain was mainly attributable to higher prices for petrochemicals (+12.6%) and fertilizers, pesticides and other chemical products (+6.9%). Higher prices for petrochemicals were partly due to the increase in the price of petroleum. Prices for fertilizers, pesticides and other chemical products partially rebounded in August after posting a record monthly decline in July (-12.1%).

Prices for motorized and recreational vehicles were up 0.5% in August, mainly on higher prices for motor vehicle engines and motor vehicle parts (+1.1%). In August, the Canadian dollar depreciated 2.0% against the US dollar. As many prices in this category are reported in US dollars, the movement in the exchange rate partially contributed to the monthly price increase in this group.

Prices for meat, fish and dairy products rose 1.2% in August. Increases were seen among several types of meat products (+1.9%), including fresh and frozen beef and veal (+3.1%), fresh and frozen pork (+2.6%), and fresh and frozen chicken (+3.0%). Higher prices for beef were partly influenced by an increase in export demand. In July, the value of Canada’s beef exports to the world and to the United States both rose on a monthly basis, after posting declines for three consecutive months.

Compared with July 2022, the export value of Canadian beef to the United States increased 22.9%. While demand was strong, supply remained tight for cattle. As of August 1, the number of cattle on feed fell in both Canada and the United States compared with the same date in 2022, and slaughter counts were also down year over year in the month of August 2023.

Fresh and frozen pork prices rose for a fifth consecutive month in August, with higher domestic and US demand coupled with shrinking inventory contributing to the ongoing upward trend. In July, the total export value for both Canadian live hog and pork meat to the United States rose for the second consecutive month. In the meantime, US pork cold storage fell for a third month in a row in July 2023 and was 10.0% lower compared with July 2022.

Prices for pulp and paper products rose 1.8% on a monthly basis in August 2023, mainly due to higher prices for wood pulp (+5.3%), which posted its first monthly increase since March 2023.

Prices for softwood lumber fell 6.0% month over month in August, after posting a 15.5% increase in July. On a yearly basis, prices were down 26.1% in August. The monthly price decline was partly attributable to a slowdown in construction activities, as well as an increase in supply with some previously curtailed production returning to operation across North America.

Raw Materials Price Index

The RMPI increased 3.0% month over month in August and fell 4.3% compared with the same month in 2022. Excluding crude energy products, the RMPI rose 0.2% month over month and 1.2% year over year.

Prices for crude energy products rose 7.4% in August 2023, after posting a 7.8% increase in July. Compared with August 2022, prices for crude energy products dropped 11.9%. The monthly increase was mainly due to higher prices for conventional crude oil (+7.8%) and synthetic crude oil (+7.2%).

Prices for animals and animal products rose 0.9% in August. Prices for hogs were up 3.9%, while prices for fish, crustaceans, shellfish and other fishery products increased 3.2%.