Mergers, Acquisitions and the Canadian Electrical Market

Nov 2, 2021

By John Kerr

Consolidation is a natural evolution in any industry: technology changes, customers demand more, and the need to drive costs all contribute to this activity. The Canadian electrical market is mature but opportunities still exist in its related segments.

The reality is we are entering a new stage driven by how we define ourselves and how we respond to customer needs. We all understand segmentation today more than ever and desire to provide end users with greater value. End users’ total solutions are bringing together the entire industry, across all its specialized disciplines of for full line, lighting, controls, etc.

We have often expressed the need for distributors to look at the inside workings of their businesses and ask themselves if they have enough engineering capability to meet the needs of a more demanding end user. Get ready: we see this accelerating so ensure you have a competitive edge.

Lately we have witnessed a lot of mergers and acquisitions activity among electrical distributors. The merger of Wesco and Anixter was huge, creating the largest distributor of electrical equipment in Canada. But activity continued alongside that, with Guillevin and Deschenes adding solid independents to their circle. Rexel too was active.

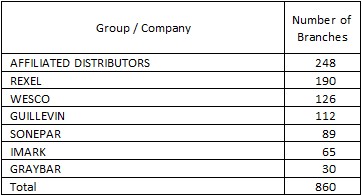

So, what does Canada look like after all this M&A activity?

Here, channel consolidation has been going on for years and this will no doubt continue. Here is a look at the market in terms of branches, comparing the marketing groups and the multinationals. There are 949 full line branches in Canada, which represent 90.6% of all full line branches in Canada.

Based on this table, IMARK, Affiliated Distributors and the balance of independents not listed total 402 branches or 42% of the market. Based on this one might say consolidation is not a factor here.

The story is different when the measure is in dollars. Multinational owners of full line distribution in Canada control a 75.4% share. Add marketing groups and this number soars to 97.2%

So where does the market look to add and grow? What opportunities are out there? Sonepar bought Vallen years ago, Wesco acquired Hazmasters while Franklin Empire bought Ontor and Milltronics, and E.B. Horsman acquired MCL and Intec. All these moves were what many call close to core, where the firms bought represented synergy in the product, market, or customer mix.

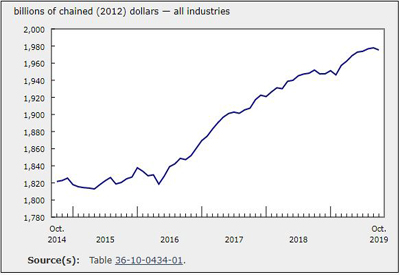

The Canadian electrical market when defined as the combined sales for full line, utility, control, lighting and surplus is approaching $12.4 billion today. And within each of those segments there is great opportunity. There is a crossover in customers and products, and the specialized segments require consideration in terms of the staffing required to support the more technical products and solutions.

COVID has been credited with accelerating M&A activity, but M&As have been in many business plans for years. Alongside this, financial clout, digitalization, and the ability to take a longer view have all made this work.

Our question now is who will be acquired next, and who will be target. Our bet is it won’t be a full line distributor but rather one that is specialized and focused. Interesting days ahead. John Kerr is Publisher of CEW; johnkerr@kerrwil.com.