Wholesale Sales Grew 0.3% in August

Oct 27, 2020

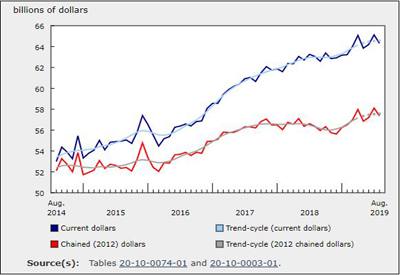

Wholesale sales grew for a fourth consecutive month in August, though at a much slower pace compared with the previous three months. Sales edged up 0.3% to $65.7 billion in August after growing 5.2% in July. While four of seven subsectors increased in August, led by higher sales in the building material and supplies and the motor vehicle and motor vehicle parts and accessories subsectors, declines in the personal and household goods and the food, beverage and tobacco subsectors partially offset the increases.

In volume terms, wholesale sales increased 0.1% in August.

Sales remain above pre-pandemic levels

After growing for the fourth consecutive month, wholesale sales in August were 1.7% above pre-COVID-19 levels. Four subsectors reported shipments in August that were higher than in February 2020, led by miscellaneous goods, and building material and supply sales. Subsectors remaining below pre-COVID-19 levels included motor vehicles and motor vehicle parts and accessories; food, beverage and tobacco; and personal and household goods.

Motor vehicle and motor vehicle parts and accessories remained the subsector whose sales were the furthest below February 2020 levels — notwithstanding a 2.5% increase in August. Sales were 7.1% below pre-pandemic levels, reflecting import levels that were 7.8% below February 2020. Companies with assembly plants in Canada were also still recording wholesale sales below pre-pandemic levels, despite the fact that their manufacturing operations have recovered. This lag in auto sales is not unexpected given the multinational nature of the supply chain and higher savings rates among Canadians over the past few months, which may reflect a reluctance to undertake large durable good expenditures.

Sales were higher in eight provinces in August than in February 2020, led by British Columbia, whose sales were $437 million (+6.9%) above pre-pandemic levels. Sales in Nova Scotia and Saskatchewan in August were more than 10% above February 2020. Alberta and Newfoundland and Labrador recorded sales lower than February 2020 after weaker sales in August. Sales in the latter two provinces had previously returned to pre-COVID-19 levels.

Higher sales in building material and supplies and in motor vehicle and motor vehicle parts and accessories

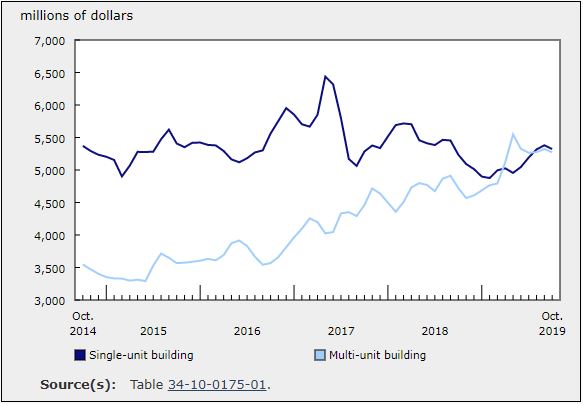

Sales in the building material and supplies subsector reached a record high level of $9.8 billion, as sales rose for a fourth consecutive month in August (+7.0%). The increase in August was mainly due to stronger activity in the lumber, millwork, hardware and other building supplies industry which grew 12.2% to $5.5 billion. Rising sales in this subsector reflected higher exports of lumber and other sawmill products (+16.5%) and forestry products and building and packaging materials (+7.6%). Moreover, prices of lumber and other wood products rose 2.3% in August, as reported in the Industrial Product Price Index.

The motor vehicle and the motor vehicle and parts and accessories subsector grew 2.5% to $10.9 billion. Despite strong growth in four consecutive months, sales in this subsector did not surpass the level seen in February. When the COVID-19 pandemic started to spread throughout the globe, this subsector was the hardest hit in March (-22.7%) and April (-66.3%) partly due to the nature of the subsector. Demand for these products dropped significantly while mandatory shutdowns disrupted the supply chain. In addition, the need to drive has dropped significantly as people are working from home, reducing travel and are encouraged to limit interpersonal interactions.

Sales fell 3.1% to $9.6 billion in the personal and household goods subsector, mainly due to declines in the pharmaceutical and pharmacy supplies industry which decreased for a second consecutive month in August (-6.0% to $4.9 billion). Sales in this industry have declined four times since February, with August results 5.1% lower than February levels.

After remaining almost unchanged in July, sales in the food, beverage and tobacco subsector declined 2.4% to $12.0 billion in August, almost entirely due to lower sales in the food industry (-2.9% to $10.4 billion). Food sales were 3.2% lower than their February level, accounting for most of the decline in the food, beverage and tobacco subsector which was 1.1% lower than in February.

British Columbia and Quebec lead the increase

Sales in British Columbia rose 4.7% to $6.7 billion in August, a record level for the province. Four of the seven subsectors recorded higher sales and after four months of consecutive growth, the building material and supplies subsector reached a new record high level in August. The subsector also reported the highest gains (+10.9% to $1.9 billion), followed by the motor vehicle and motor vehicle parts and accessories subsector (+22.0% to $870 million).

Sales in Quebec increased by 1.2% to $12.4 billion in August, also a record level for the province. Five of the seven subsectors reported increases in sales, led by the motor vehicle and motor vehicle parts and accessories subsector (+12.6% to $1.6 billion) and the building materials and supplies subsector (+7.5% to $2.1 billion). However, gains in the motor vehicle and motor vehicle parts and accessories subsector were largely offset by declines in the food, beverage and tobacco products subsector (-5.7% to $2.9 billion).

Alberta showed the biggest decline in August, with sales decreasing 2.1% to $6.5 billion. Five of the seven subsectors showed declines, led by the machinery, equipment and supplies subsector (-5.2% to $1.9 billion).

No change in inventories

Wholesale inventories were flat in August, at $90.0 billion.

Higher inventories in four of the seven subsectors were offset by lower inventories in the other three subsectors. The largest increase in inventories was recorded in the machinery, equipment and supplies subsector (+0.9% to $26.4 billion), whereas the largest decrease in inventories was recorded in the building material and supplies subsector (-2.4% to $14.0 billion).

The inventory-to-sales ratio remained unchanged at 1.37 from July to August. This was the lowest level since August 2018. The inventory-to-sales ratio is a measure of the time (in months) required to exhaust inventories if sales were to remain at their current level.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/201019/dq201019a-eng.htm?CMP=mstatcan