The Right Price to Get the Order — the Last Look

December 1, 2015

Paul Eitmant

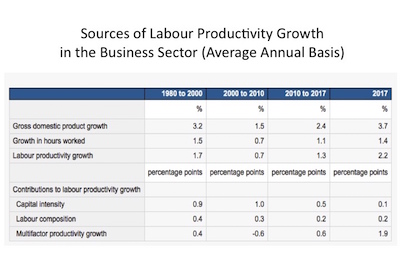

Text book definition: pricing is the process whereby a business sets the price at which it will sell its products and services, and may be part of the business’s marketing plan. In setting prices, the business will take into account the price at which it could acquire the goods, the manufacturing cost, the market place, competition, market condition, brand, and quality of product.

I remember that when I first started in the electrical industry (1973) it was simple. We had a list price (Blue Price Sheet) and we gave stocking distributors 50% off for all our products. At the same time, we did have a quotation system, which we used to fill a form (paper with carbon copies) that was sent to our district and regional offices for safekeeping. Life was good. Until one day, I was using the quotation system for a local construction project and my local distributor called and stated we lost the project to a distributor 200 miles away. I was perplexed and not happy. So I called my regional manager in this city and he stated he gave an extra 5% to his distributor. Well, I did learn a new term called the extra 5% = the last look.

This trend continued to expand to 50/5/5/5/5% and never seemed to stop. This process is just an example were competitors will continue to use price to gain distributor shelf space and take a large order at any price to gain the order.

During my corporate years I remember when I took over the a division and during the first few months I had numerous requests from our customer service department for that extra 5% for large orders. After reviewing the market and the particular products listed, I came to the conclusion that our company was just giving away profits. My action was quick and swift. I walked into the customer service department and stated in the loud voice that this practice was to stop today. After the president heard of this action, he was not happy. I stated, “Just wait and see the results at the end of the quarter.” Well, both sales and profits were up for that quarter and the rest of the year.

At the same time, there were certain manufacturers that had rigid pricing policies and they never got into the habit. My hat goes off to these companies, which had the marketing senses and confidence in their products to weather the storm.

I always try to be positive and hope things will change for the better and one of these days our industry will come back to reality and try to stick to simple pricing policies.

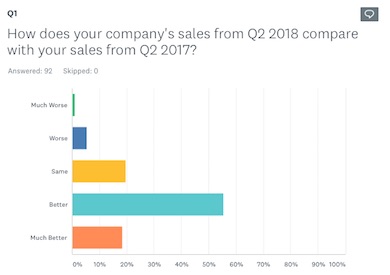

Well, I was reminded last week talking with an old friend still very active in our industry that things have not changed. A large order, they were specified and very large distributor stated they need additional discount to achieve the order. Like most manufacturers, they have multi distributors quoting on this order and they were trying to achieve an advantage. Therefore, the manufacturer was just going to compete against himself and make less profit on the order.

My friend did state he was going to refuse the request and went on to say that he may even evaluate the possibility of termination. Something has to change, because everyone has risings cost and the bottom line of profits for distributors/manufacturers) is sinking.

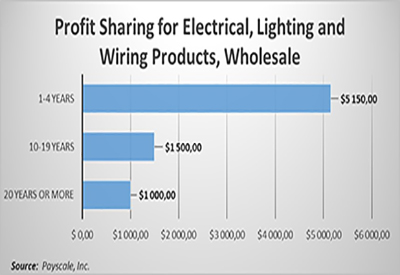

Today manufacturers carry the additional cost of marketing development programs, corporate rebates, and multi-tiered pricing policies, marketing groups and the new revised electronic quotation systems.

I recently read an article by Marco Bertini, an associate professor of marketing management at ESADE Business and Law School. Here’s what he wrote.

Focus on relationships, not on transactions

Consumers often come to identify with the brands they buy, and firms hope to encourage this, preferring loyal customers to ones who engage on a merely transactional basis. But pricing decisions often undermine the relationship between brands and their followers. While a firm’s brand communications may say, “We value you as a person,” its pricing practices often say, “We value you as a wallet.” Customers instantly pick up on the inconsistency and respond accordingly.

It would be great to go back in time and discuss pricing with Thomas Edison and Nikola Tesla during the 1893 World’s Fair contract. Edison’s bid (DC System) was $1.4 million and Telsa’s (AC Polyphase System) was $554,000. No extra 5% on this bid. However, the 1895 West Niagara Power Station was much closer with Telsa, who again won the contract through Westinghouse.

Read more from Paul Eitmant in CEW:

– A New Player in the Canadian Gray Market

– The Cost of Bad Leaders

– NAFTA Still a Good Show

– On Being an Effective Coach

– The Biggest Risks to Canada’s Economy In 2015 and Beyond

– Networks and Lighting Standards – Follow Up – One Year later

– How Healthy is Your Business?

– Social Media: Is It the Future for the Electrical Industry?

– Customer Service: A Key to Success

– The Good Old Boys Club “Changing of the Guard”

– Who’s Next Within North America’s Electrical Distributor Channel?

– Generation Y – Next Generation – Never to old to Learn!

– LEDs: the Fastest Growing Product/Market for 2015

Paul Eitmant is President and CEO of IP Group International, which serves the needs of business-to-business enterprises in over 30 countries worldwide by adding specialized expertise to the business planning and implementation process; Tel: 480.488.5646; paulipgroup@cox.net